Import invoices into Xero fast and easy using Business Importer.

How to import Invoices into Xero with Business Importer in 5 simple steps

To import invoices into Xero, please, follow 5 simple steps:

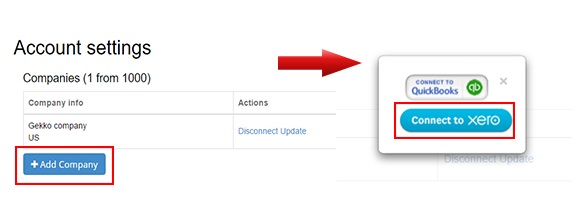

1. Sign in to Business Importer and connect it to Xero.

To connect Business Importer and Xero go to:

Accounts – Add company – Xero

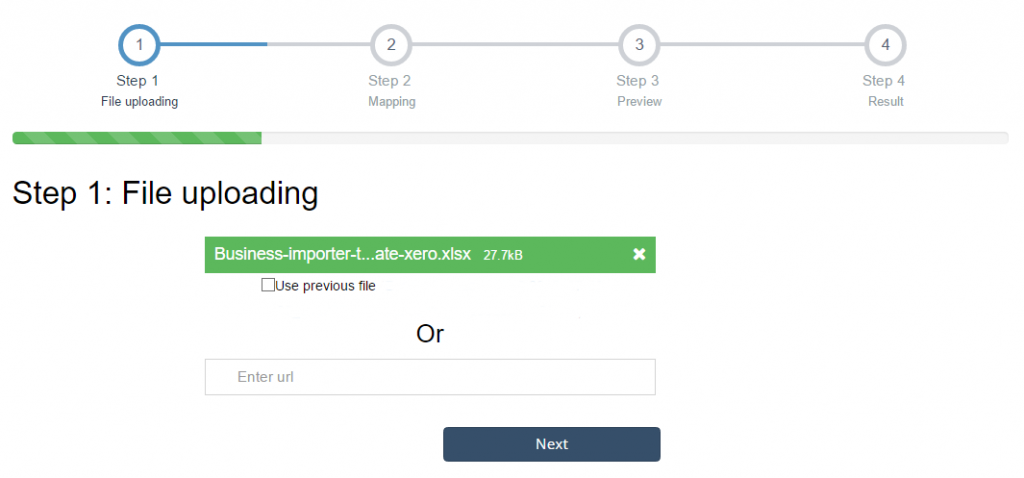

2. Go to Import tab. Upload your Excel file or paste the DropBox or Google.Drive link. Click on the Next button.

*Important Notes for your Invoices spreadsheets:

Invoice number – Unique alpha numeric code identifying invoice.

Line: Tax Type – Valid values: Tax on Purchases , Tax Exempt , Tax on Sales , Sales Tax on Imports.

Line: Amount = Line: Quantity * Line: Unit price

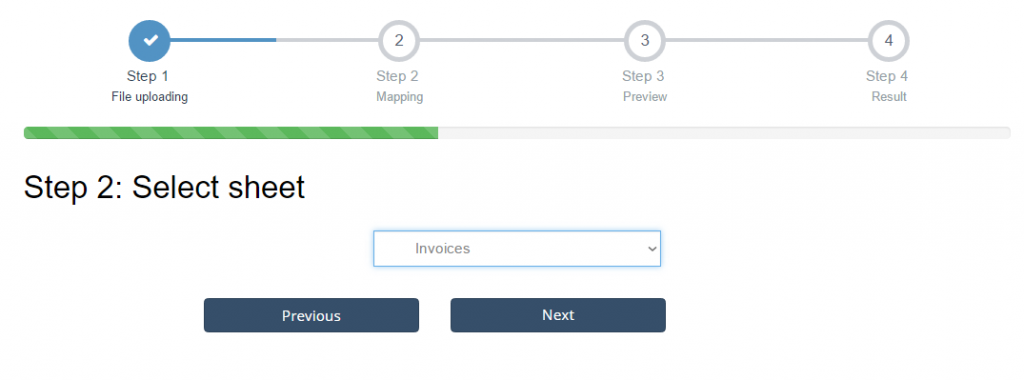

3. Choose the list in your Excel, which contains Invoices you want to import into Xero. Click on the Next button.

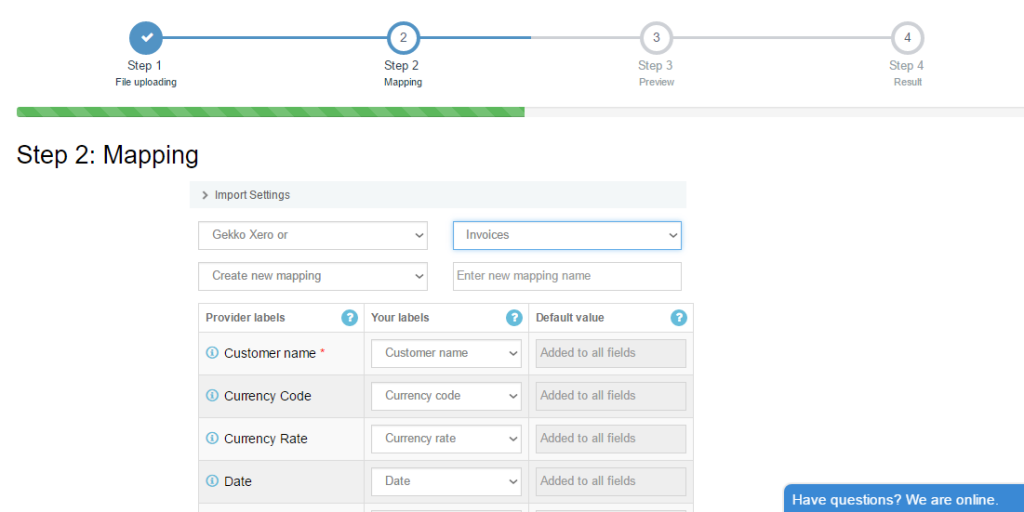

4. Select Company (you want to import to) and Entity (Invoices), and create mapping – connect Xero labels* to Your Labels**. Press the Next button.

*Xero labels – Xero fields in invoices are required to be filled in.

**Your labels – your spreadsheet columns containing all information on invoices you want to import into Xero.

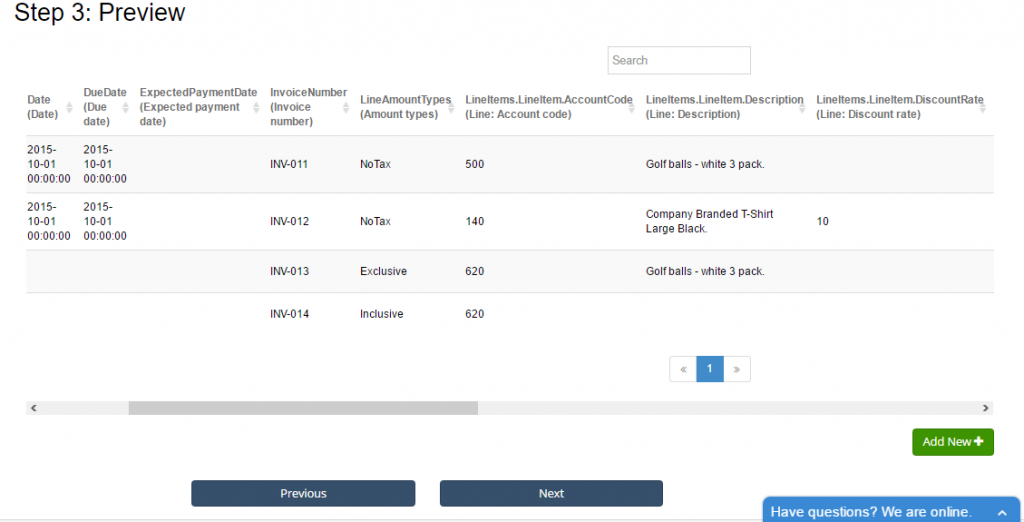

5. Review if the information is entered correctly and click on the Next button.

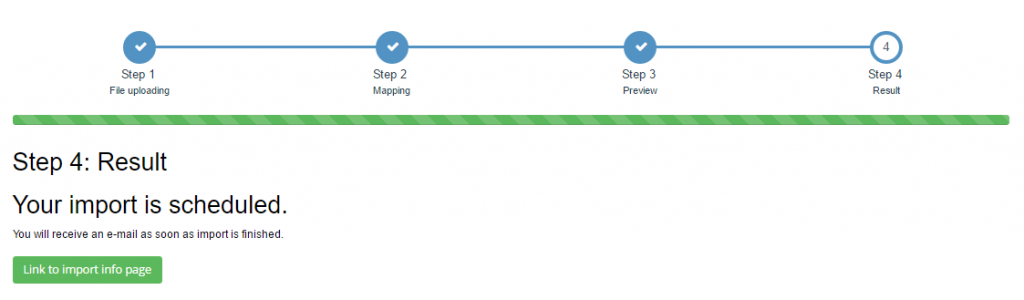

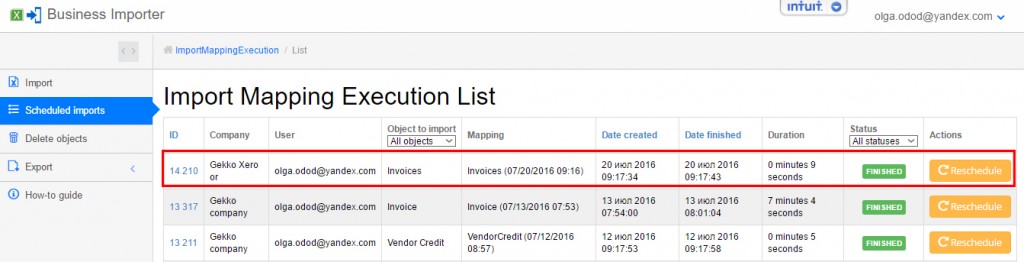

Your import is in process. Don’t wait until it’s done – you will be notified by e-mail.

See your Invoices import into Xero result in your e-mail or in the Scheduled imports tab.

Or check it out at your Xero account.

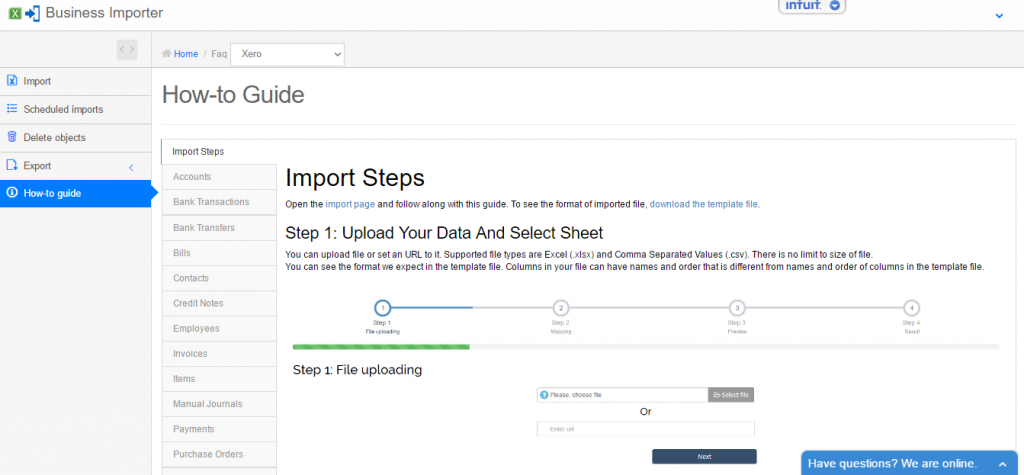

How-to Guide – How to import Invoices into Xero

Find a detailed How-to guide in Business Importer. It will help you prepare your spreadsheets that contain invoices, bills, purchase orders, receipts, credit notes, etc. you want to import into Xero.

Here is a small table that will help you to prepare your Excel properly and create correct mapping:

| Xero Field | Business Importer Name | Description | Example |

|---|---|---|---|

| Customer name | Customer name | Name of your contact | Bill Green |

| Currency Code | Currency Code | 3 letter alpha code for the currency. Example: USD, NZD, EUR, etc. | USD |

| Currency Rate | Currency Rate | Exchange rate to base currency when money is spent or received. e.g. 0.7500 Only used for bank transactions in non base currency. | 0.7500 |

| Invoice date | Date | Date format: yyyy-MM-dd, e.g. 2015-05-20.You can change it on Settings page. | 2015-05-20 |

| Due date | Due date | Date when the payment of the transaction is due. Date format: yyyy-MM-dd, e.g. 2015-05-20. You can change it on Settings page. | 2015-05-20 |

| Expected payment date | Expected payment date | Date format: yyyy-MM-dd, e.g. 2015-05-20.You can change it on Settings page. Shown on sales invoices (Accounts Receivable) when this has been set. | 2015-05-20 |

| Invoice number | Invoice number | Unique alpha numeric code identifying invoice (when missing will auto-generate from your Organisation Invoice Settings). This value will also display as Reference in the UI. | INV-001 |

| Line Amount Types | Amounts are | Valid values: Exclusive, Inclusive, NoTax. | Inclusive |

| Reference | Reference | Additional reference number | 1234-5678-999 |

| Sent to contact | Sent to contact | The invoice in the Xero app should be marked as “sent”. This can be set only on invoices that have been approved. Valid values: true or false. | true |

| Status | Status | Valid values: DRAFT, SUBMITTED, AUTHORISED. | SUBMITTED |

| Url | Url | Please, provide a valid URL, associated with the transaction. URL link to a source document – shown as “Go to [appName]” in the Xero app. | https://api.xero.com/api.xro/2.0/Invoices |

| Line | Line: Account Code | Provide an alpha numeric account code e.g 200 or SALES | 200 |

| Line: Description | Free form text description of the line item that appears in the printed record. Maximum of 4000 chars. | Golf balls – white 3 pack. | |

| Line: Discount rate | Decimal like 15 | 15 | |

| Line: Item Code | User defined item code (max length = 30) | 567 | |

| Line: Amount | The amount of the line item. | 300.00 | |

| Line: Quantity | Number of items for the line. | 3 | |

| Line: Tax amount | The tax amount is auto calculated as a percentage of the line amount based on the tax rate. | 70.00 | |

| Line: Tax Type | Define a tax type: Tax on Purchases , Tax Exempt , Tax on Sales , Sales Tax on Imports (for US). | Tax on Purchases | |

| Line: Region | Tracking ID | ae777a87-5ef3-4fa0-a4f0-d10e1f13073a | |

| Line: Unit price | Unit price of the subject item as referenced by ItemRef. | 100.00 |

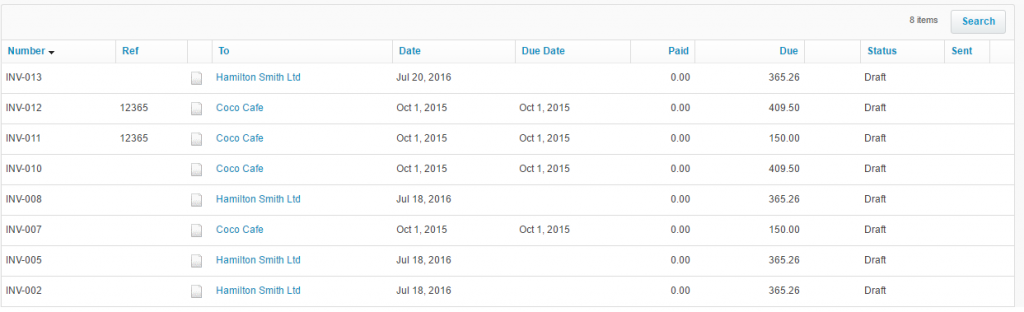

Check out the Invoices import results

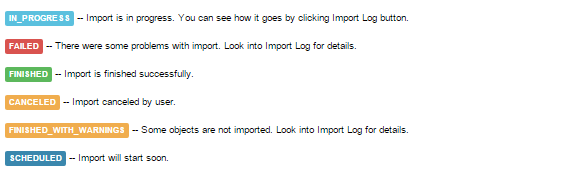

There are 5 types of import results.

Errors in the Invoices import

The most common errors and the ways to solve them.

There are 4 the most common errors made by our clients when they import Invoices into Xero. To prevent this happening, we have reviewed all of them and given solutions below.

| Problem | Error occurs | Solution | Correct example |

|---|---|---|---|

| Wrong tax type. | WARNING Value ‘[INPUT]’ for ‘Line: Tax Type’ invalid. | Valid values: Sales Tax on Imports, Tax Exempt, Tax on Purchases, Tax on Sales. | Tax on Sales |

| Total amount ( Line: Amount) is incorrect. | ERROR Invoice INV-015 : The line total 200.00 does not match the expected line total 150.00 | Line: Amount= Line: Quantity*Line: Unit price | Line: Amount= Line: Quantity*Line: Unit price |

| No Unit Price in invoice with filled in discount. | ERROR Invoice INV-016 : The UnitAmount should be used when specifying a discount for a line item. | Please, provide a Unit price. | 5.00 |

| Line: Description is empty. | ERROR Invoice INV-018 : The description field is mandatory for each line item. | Please, provide description to the invoice (goods, services). | Golf balls – white 3 pack. |

Remember, that any question you can address us. We will be glad to help you!

Just leave us a message, call us on (469) 629-7891 or write to support@cloudbusinesshq.com.

Comments open