Import Purchase Orders into Xero fast and easy, using Business Importer.

How to import Purchase Orders into Xero with Business Importer in 5 simple steps

To import Purchase Orders into Xero, please, follow 5 simple steps:

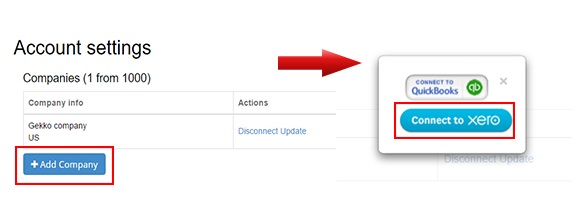

1. Sign in to Business Importer and connect it to Xero.

Connect Business Importer and Xero go to:

Accounts – Add company – Xero

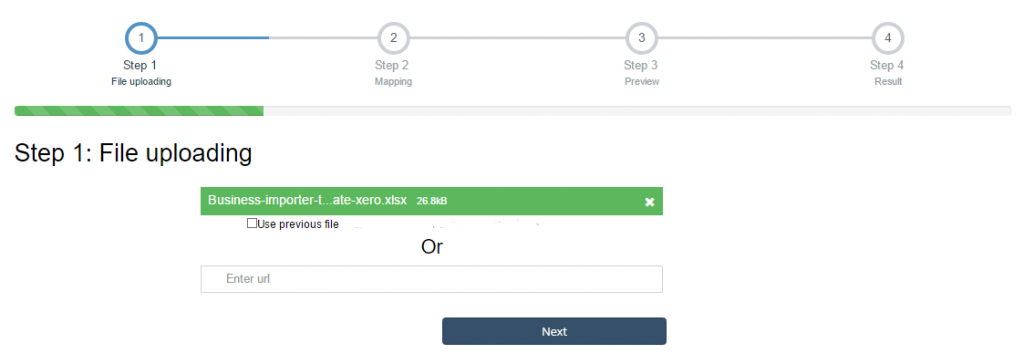

2. Go to Import tab. Upload your Excel file or paste the DropBox or Google.Drive link. Click on the Next button.

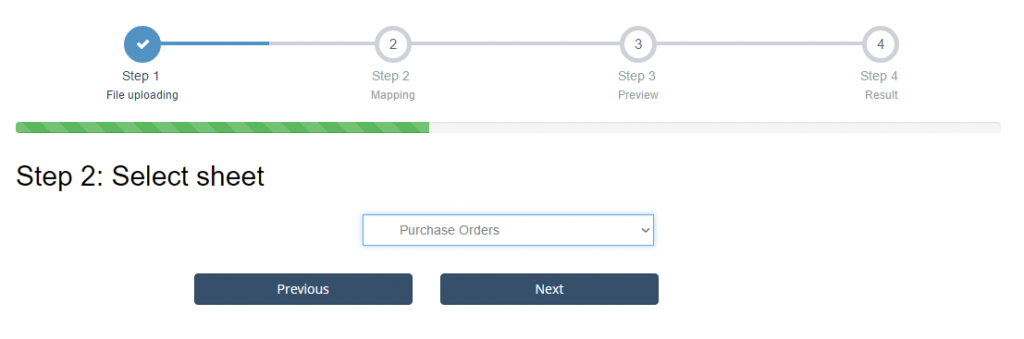

3. Choose the list in your Excel, which contains Purchase Orders you want to import into Xero. Click on the Next button.

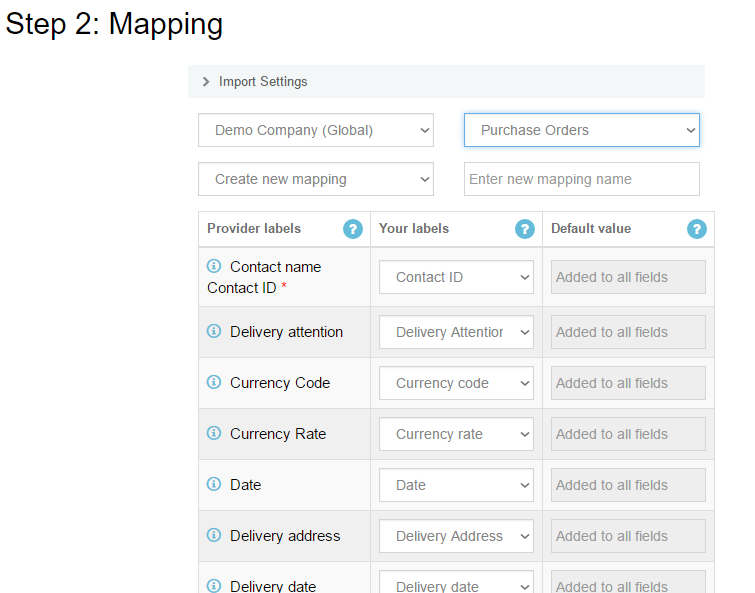

4. Select Company (you want to import to) and Entity (Purchase Orders), and create mapping – connect Xero labels* to Your Labels**. Press the Next button.

*Xero labels – Xero fields in Purchase Orders that are required to be filled in.

**Your labels – your spreadsheet columns containing all information on Purchase Orders you want to import into Xero.

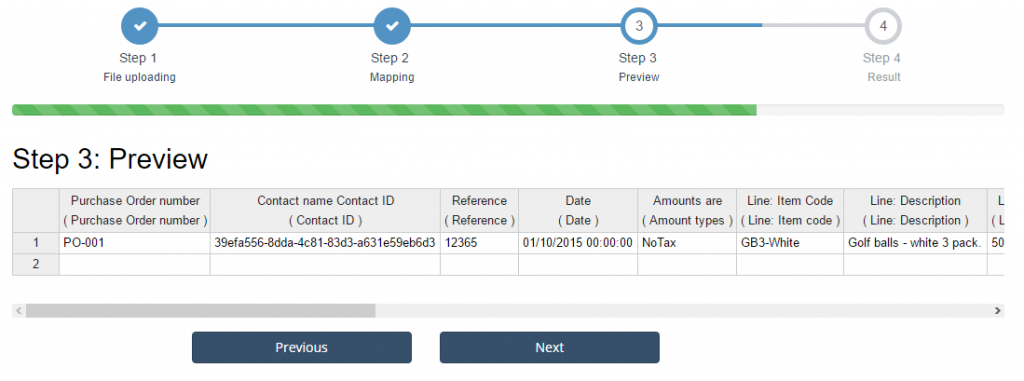

5. Review* if the information is entered correctly and click on the Next button.

*Correct data if necessary – on this stage you can manually change data in the columns you are going to import into Xero.

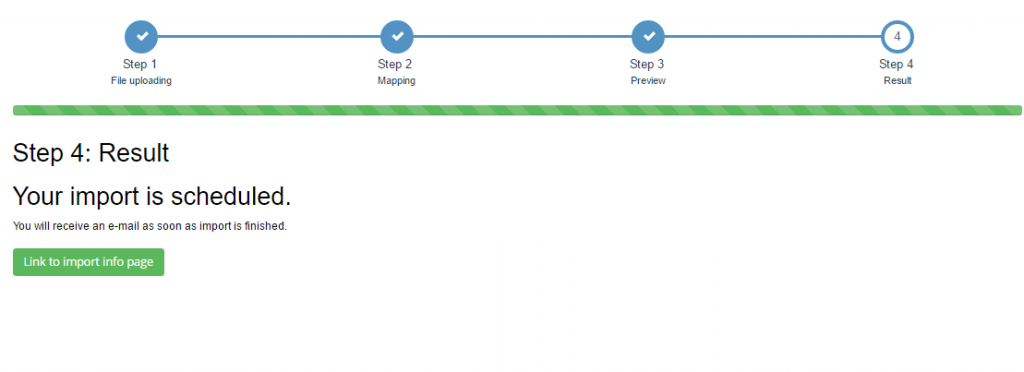

Your import is in process. Don’t wait until it’s done – you will be notified by e-mail.

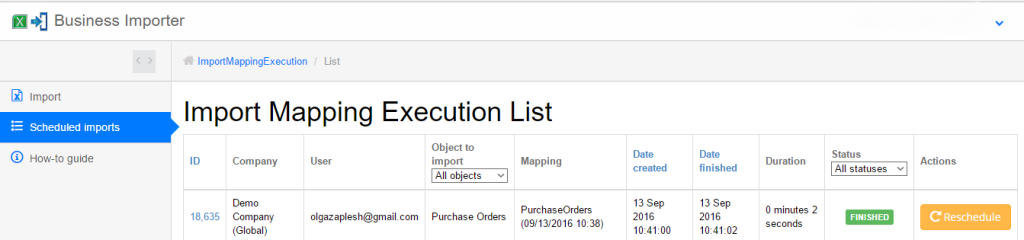

Check out your Purchase Orders import into Xero result in your e-mail or in the Scheduled imports tab.

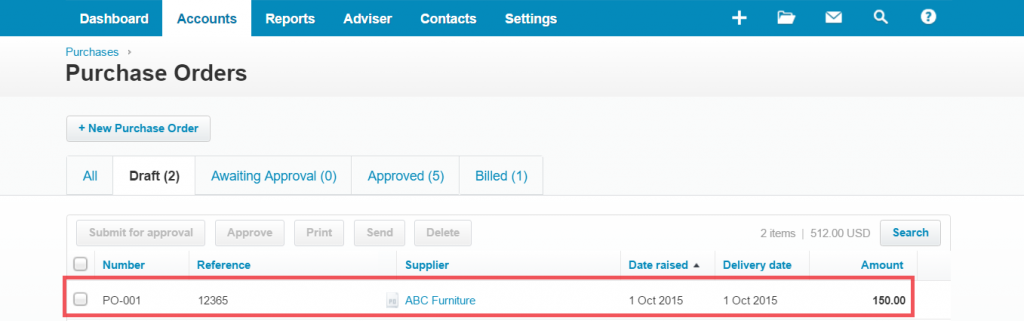

Or check out the results at your Xero account.

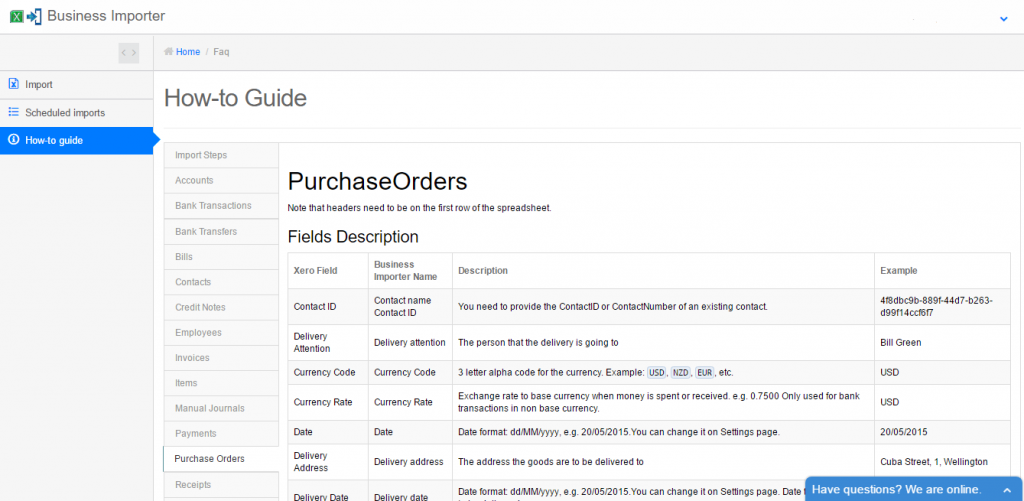

How-to Guide – How to import Purchase Orders into Xero

Find a detailed How-to guide in Business Importer. It will help you prepare your spreadsheets that contain Purchase Orders, Invoices, Bills, Manual Journals, Bank Transactions, Receipts, Credit Notes, etc. you want to import into Xero.

| Xero Field | Business Importer Name | Description | Example |

|---|---|---|---|

| Contact ID | Contact name Contact ID | You need to provide the ContactID or ContactNumber of an existing contact. | 4f8dbc9b-889f-44d7-b263-d99f14ccf6f7 |

| Delivery Attention | Delivery attention | The person that the delivery is going to | Bill Green |

| Currency Code | Currency Code | 3 letter alpha code for the currency. Example: USD, NZD, EUR, etc. | USD |

| Currency Rate | Currency Rate | Exchange rate to base currency when money is spent or received. e.g. 0.7500 Only used for bank transactions in non base currency. | USD |

| Date | Date | Date format: dd/MM/yyyy, e.g. 20/05/2015.You can change it on Settings page. | 20/05/2015 |

| Delivery Address | Delivery address | The address the goods are to be delivered to | Cuba Street, 1, Wellington |

| Delivery Date | Delivery date | Date format: dd/MM/yyyy, e.g. 20/05/2015.You can change it on Settings page. Date the goods are to be delivered. | 20/05/2015 |

| Delivery Instructions | Delivery instructions | A free text feild for instructions (500 characters max) | Receive confirmation |

| Expected Arrival Date | Expected arrival date | Date format: dd/MM/yyyy, e.g. 20/05/2015.You can change it on Settings page. The date the goods are expected to arrive. | 20/05/2015 |

| Amount Types | Amounts are | Line amounts are exclusive of tax by default if you don’t specify this element. Valid values: Exclusive, Inclusive, NoTax. | Exclusive |

| Purchase Order Number | Purchase Order number | Unique alpha numeric code identifying purchase order (when missing will auto-generate from your Organisation Invoice Settings) | PO-001 |

| Reference | Reference | Additional reference number | 1234-5678-999 |

| Sent To Contact | Sent to contact | Define whether the purchase order should be marked as “sent”. This can be set only on purchase orders that have been approved or billed. Valid values: true or false. |

true |

| Status | Status | Valid values: DRAFT, SUBMITTED, AUTHORISED, BILLED, DELETED. | AUTHORISED |

| Delivery Telephone | Delivery telephone | The phone number for the person accepting the delivery | 5678935 |

| Line | Line: Account Code | Alpha numeric account code e.g 200 or SALES | 200 |

| Line: Description | Free form text description of the line item that appears in the printed record. Maximum of 4000 chars. | Golf balls – white 3 pack. | |

| Line: Discount rate | Percentage discount being applied to a line item | 15 | |

| Line: Item Code | The Xero generated identifier for a LineItem. | GB3-White | |

| Line: Quantity | Number of items for the line. | 3 | |

| Line: Tax Type | Used as an override if the default Tax Code for the selected is not correct. Valid values: INPUT, NONE, OUTPUT, GSTONIMPORTS. | INPUT | |

| Line: Region | Optional Tracking Category. | 297c2dc5-cc47-4afd-8ec8-74990b8761e9 | |

| Line: Unit price | Unit price of the subject item as referenced by ItemRef. | 100.00 |

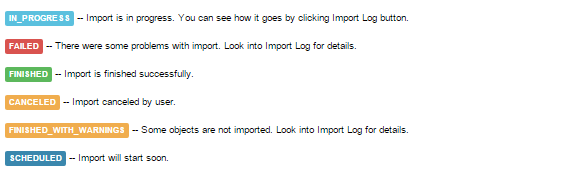

Check out the Purchase Orders’ import results

There are 5 types of import results.

Errors in the Purchase Orders import into Xero

The most common errors and the ways to solve them.

There are 4 the most common errors made by our clients when they import Purchase Orders into Xero. To prevent this happening, we have reviewed all of them and given solutions below.

| Problem | Error occurs | Solution | Correct example |

|---|---|---|---|

| Invalid Account Code | Account code ‘500’ is not a valid code for this document. | Please, provide valid account code for Purchase Order. | 090 |

| No AccountCode provided | The AccountCode field is mandatory. | Please, provide AccountCode for your Purchase Order. | 090 |

| Invalid Contact ID (or Number) | Unknown contact details. | Please, provide a valid ContactID or Contact Number. | 39efa556-8dda-4c81-83d3-a631e59eb6d3 |

| A Purchase Order with the same number has been already created in your Xero account. | Order number must be unique. | If you provided the Purchase Order number that has been already used, please, provid a unique Purchase Order number. | PO-002 |

Remember, that any question you can address us. We will be glad to help you!

Just leave us a message, call us on (469) 629-7891 or write to support@cloudbusinesshq.com.

Comments open