If you are going to import Invoices, Bills, Sales Receipts, etc. for US-clients into QuickBooks Online, and you need to apply US taxes correctly, you should use Business Importer. Read how to import Invoces with Sales Tax for US clients into QuickBooks Online.

How to Import Invoices into QuickBooks Online that contain Sales TAX for US clients

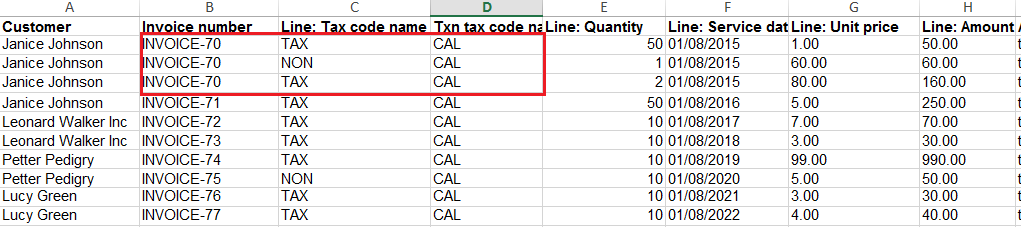

STEP 1. Prepare your Excel with US Invoices you are going to import into QuickBooks Online. Pay attention to the following columns: Txn tax code name and Line: Tax code name.

Txn tax code name – Reference to the transaction tax code.

Line: Tax code name – Reference to the Tax Code for this item. Values: TAX or NON. If TAX – you need to fill in Transaction tax code in the appropriate column, if NON – leave this field empty, and tax won’t be applied.

! Note: GlobalTaxCalculation is not applied in case of US taxes.

Don’t need to calculate Tax Amount in your Invoices (or other documents) – Business Importer calculates it automatically.

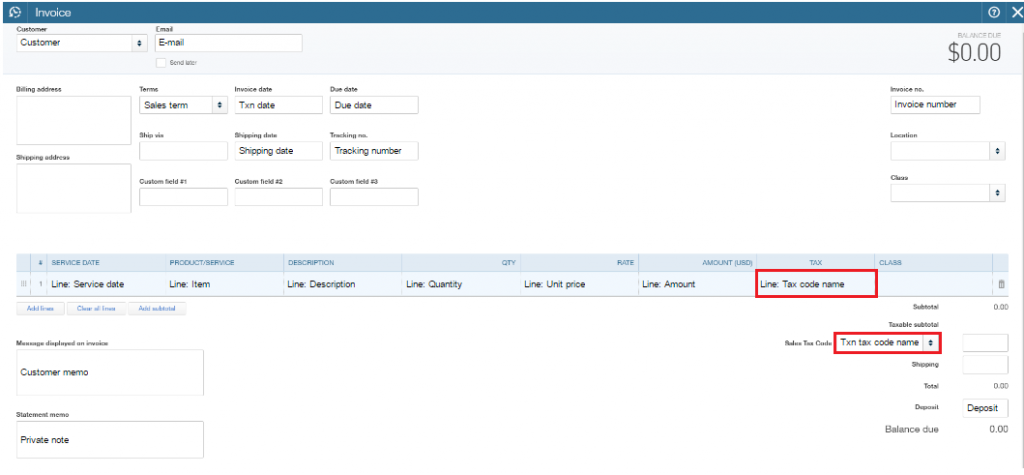

STEP 2. Start your ordinary import of invoices into QuickBooks Online in Business Importer.

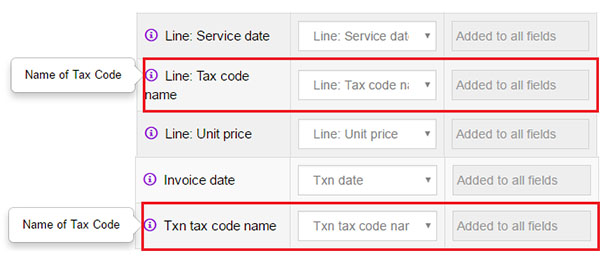

STEP 3. On the Mapping step: Map Txn tax code name to the column with Tax Code for the transaction and Line: Tax code name to the column with the Name of Tax Code (TAX or NON).

Check out the Mapping Helper* – your guide in Importing Invoices with US Sales Taxes into QuickBooks Online.

*Available on the Mapping step at Business Importer.

STEP 4. Preview your import file.

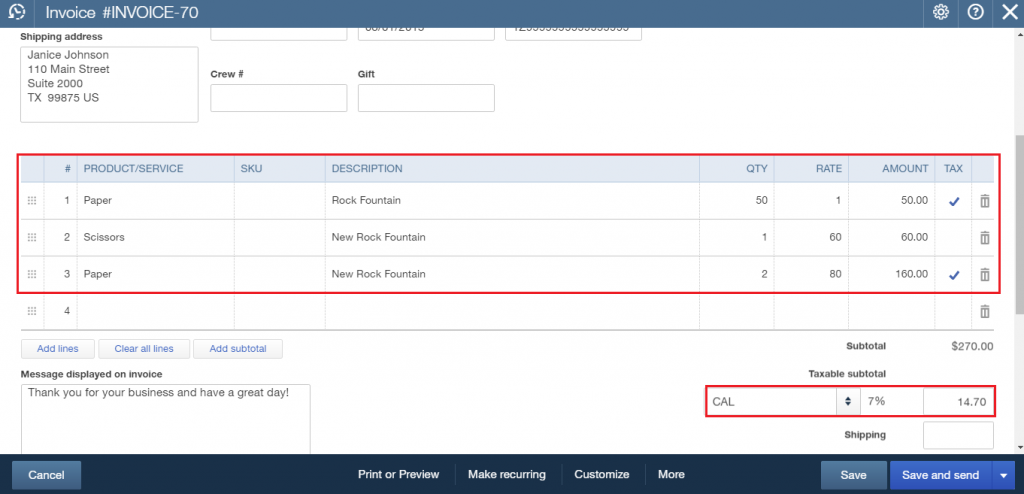

STEP 5. Finish your Import and Check out the result. Your import of Invoices with Sales TAX for US clients is ready!

Picture: Invoices with US Taxes imported into QuickBooks Online with Business Importer.

How to import transactions and apply NON-US TAX, read in the next article.

Remember, that any question you can address us. We will be glad to help you!

Just leave us a message, call us on (469) 629-7891 or write to support@cloudbusinesshq.com.

![]()