How to import Products and Services into QuickBooks Online

You can import Products and Services into QuickBooks Online with Business Importer.

To import Products and Services into QuickBooks Online, please, follow 5 simple steps:

1. Sign in to Business Importer and connect it to QuickBooks.

2. Go to Import tab. Upload your Excel file or paste the DropBox or Google. Drive link. Click on the Next button.

*Important Notes for your Products and Services lists:

Type – Choose Inventory, Non-Inventory item or Service.

Asset Account – the name of your Asset Account that tracks the current value of your Products or Services. Included in the Other Current Asset account type in the Chart of accounts in QuickBooks Online.

Income account – write ‘Sales of Product Income’.

Expense account – write ‘Cost of Goods Sold’ or Detail Type: ‘Supplies and Materials’, if purchasable.

3. Choose the list in your Excel, which contains Products and Services you want to import into QuickBooks Online. Click on the Next button.

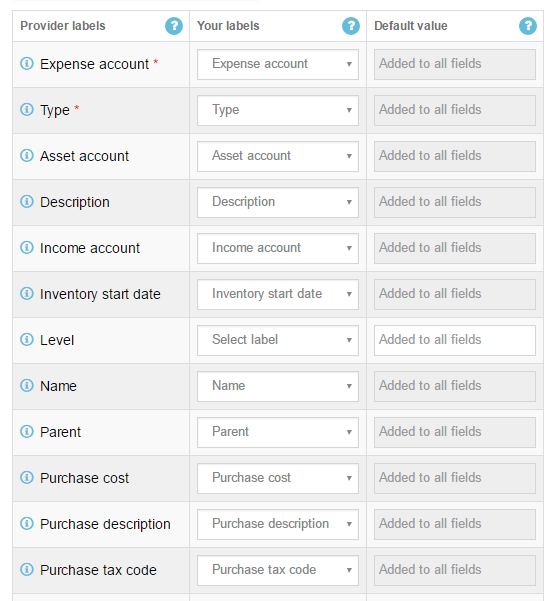

4. Select Company (you want to import to) and Entity (Products and Services), and connect Provider’s labels to Your Labels. Press the Next button.

5. Review if the information is entered correctly and click on the Next button.

Your import is in process. Don’t wait until it’s done – you will be notified by e-mail.

See your Products and Services import result in your e-mail or in Scheduled import tab.

How-to Guide – How to import Products and Services into QuickBooks online

Here is a small How-to guide that will help you to prepare your Excel properly and create correct mapping:

| QuickBooks Field | Business Importer Name | Description | Example |

|---|---|---|---|

| Name | Name | Name of product or service. Maximum of 100 chars. | Office Supplies |

| SKU | SKU | Stock Keeping Unit – unique identifier or code that refers to the particular stock keeping unit. | 45790-32 |

| Description | Description | Description of product or service. Maximum of 4000 chars. | This is the sales description. |

| Taxable | Taxable | If true, transactions for this product or service are taxable. Applicable to US companies, only. | false |

| SalesTaxInclusive | Sales tax inclusive | True if the sales tax is included in the product or service amount, and therefore is not calculated for the transaction. | false |

| UnitPrice | Unit price | Corresponds to the Price/Rate column on the QuickBooks Online UI to specify either unit price, a discount, or a tax rate for product or service. If used for unit price, the monetary value of the service or product, as expressed in the home currency. |

40 |

| Type | Type | A classification that specifies the use of this product or service. See the description at the top of the Product or Service entity page for details. Valid values include: Inventory and Service. |

Inventory |

| IncomeAccountRef | Income account | Reference to the posting Account name, that is, the account that records the proceeds from the sale of this product or service. Please, provide only it’s name or number. | Sales of Product Income |

| PurchaseDesc | Purchase description | Purchase description for product or service. Maximum of 1000 chars. | This is the purchasing description. |

| PurchaseTaxInclusive | Purchase tax inclusive | True if the purchase tax is included in product or service amount, and therefore is not calculated for the transaction. | false |

| PurchaseCost | Purchase cost | Amount paid when buying or ordering product or service, as expressed in the home currency. | 40 |

| ExpenseAccountRef | Expense account | Reference to the expense account name or account number used to pay the vendor for this product or service. Please, provide only its name. | Cost of Goods Sold |

| AssetAccountRef | Asset account | Reference to the Inventory Asset account name or account number that tracks the current value of the inventory. If the same account is used for all inventory products, the current balance of this account will represent the current total value of the inventory. Please, provide only its name. | Inventory Asset |

| QtyOnHand | Quantity on hand | Current quantity of the Inventory products available for sale. Not used for services | 100 |

| SalesTaxCodeRef | Sales tax code | Reference to the sales tax code for the Sales service. Applicable to services only. Please, provide only its name. | |

| SalesTaxInclusive | Sales tax inclusive | True if the sales tax is included in the item amount, and therefore is not calculated for the transaction. | true |

| PurchaseTaxCodeRef | Purchase tax code | Reference to the purchase tax code for product or service. Applicable to Service, Other Charge, and Product (Non-Inventory) types. Please, provide only its name. | |

| InvStartDate | Inventory start date | Date of opening balance for the inventory transaction. Required for Inventory products. Default date format is dd-MM-yyyy. You can change it on the Settings page. | 09/20/2015 |

| ParentRef | Parent | The immediate parent of the sub product or service. Please, provide only its name. | |

| Level | Level | Specifies the level of the hierarchy in which the entity is located. Zero specifies the top level of the hierarchy; anything above will be the next level with respect to the parent. Default is 0 | 2 |

| ItemCategoryType | Item Category Type | A classification that specifies the use of this item. Applicable to France companies, only. Valid values include: Product and Service. | Product |

| AbatementRate | Abatement Rate | Sales tax abatement rate for India locales. | |

| ReverseChargeRate | Reverse Charge Rate | Sales tax reverse charge rate for India locales. | |

| ServiceType | Service Type | Sales tax service type for India locales. | DEVELOPSUPPLYCONTENT |

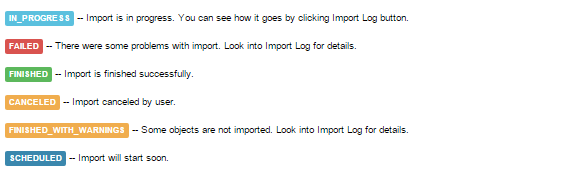

Check out the Products and Services import results

There are 5 types of import results.

Errors in the Products and Services import

The most common errors and the ways to solve them.

There are 4 the most common errors made by our clients when they import Products and Services into QuickBooks online. To prevent this from happening, we have reviewed all of them and given solutions below.

| Problem | Error occurs | Solution | Correct example |

|---|---|---|---|

| Wrong date format is used. | WARNING Error parsing date 01-14-2015: Expected format currently MM/dd/yyyy, but you can change it on your profile page. | Change date format to MM/dd/yyyy. | 01/14/2015 |

| Wrong Type of product/service is used. | ERROR Item Home Supplies222: Property Name: Can not construct an instance of com.intuit.schema.finance.v3.ItemTypeEnum from String value (“Inventory1”): value not one of declared Enum instance names: [Discount, Subtotal, Assembly, Tax Group, Tax, NonInventory, Service, Inventory, C specified is unsupported or invalid. | Please, provide a valid Type:

Inventory, Non-inventory or Service |

Inventory. |

| Wrong Income account type is used. | ERROR Item Home Supplies223: Account with Name = “Sales of Product Income2” (ID = ’82’) was CREATED in your QuickBooks Online account. Invalid account type: For an inventory product, the income account must have Account Type: ‘Income’ and Detail Type: ‘Sales of Product Income.’ | Please, provide a valid Income account. |

Sales of Product Income |

| Wrong Expense account type is used. | ERROR Item Home Supplies11113: Invalid account type: For an inventory product, the expense account must have Account Type: ‘Cost of Goods Sold’ and Detail Type: ‘Supplies and Materials.’. | Please, provide a valid Expence account. |

Cost of Goods Sold |

Remember, that any question you can address us. We will be glad to help you!

Just leave us a message, call us on (469) 629-7891 or write to support@cloudbusinesshq.com.

Comments open