Import Cash Expenses into QuickBooks Online fast and easy, using Business Importer.

How to import Cash Expenses into QuickBooks Online: 5 steps

To import Cash Expenses to QuickBooks Online, please, follow 5 simple steps:

1. Sign in to Business Importer and connect it to QuickBooks.

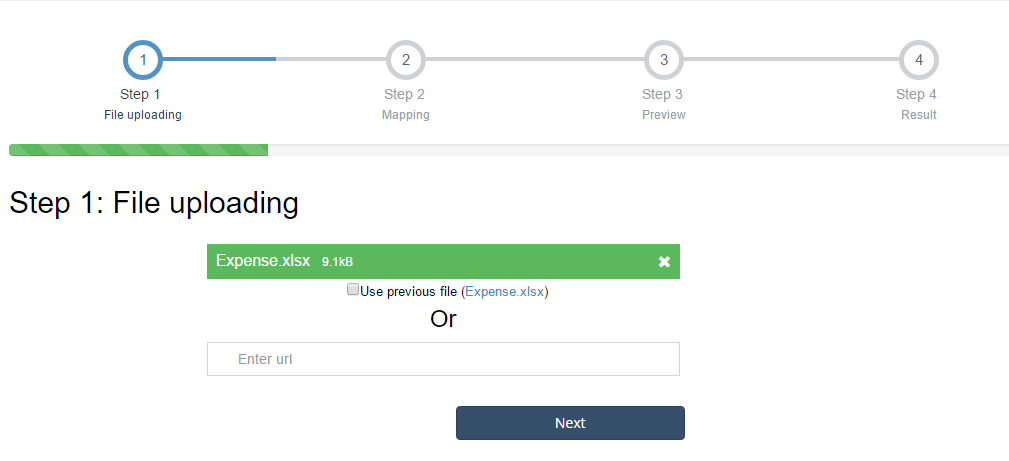

2. Go to Import tab. Upload your Excel file or paste the DropBox or Google.Drive link. Click on the Next button.

3. Choose the list in your Excel, which contains Cash Expenses you want to import into QuickBooks Online. Click on the Next button.

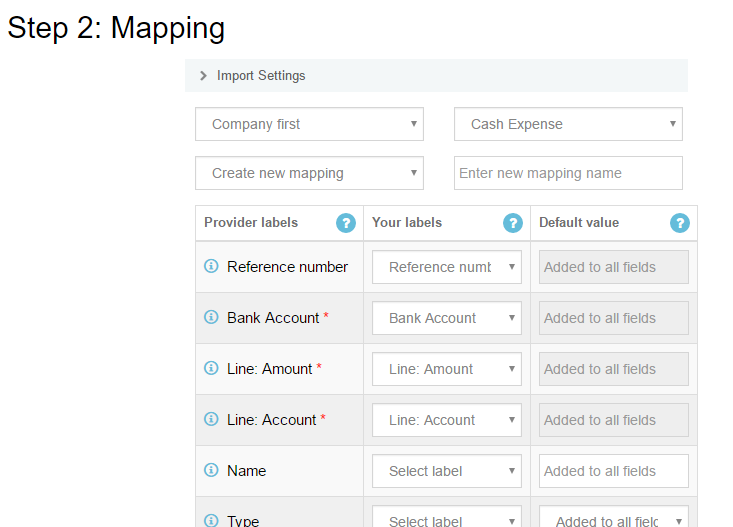

4. Select Company (you want to import to) and Entity (Cash Expenses), and connect Provider’s labels to Your Labels (create Mapping). Press the Next button.

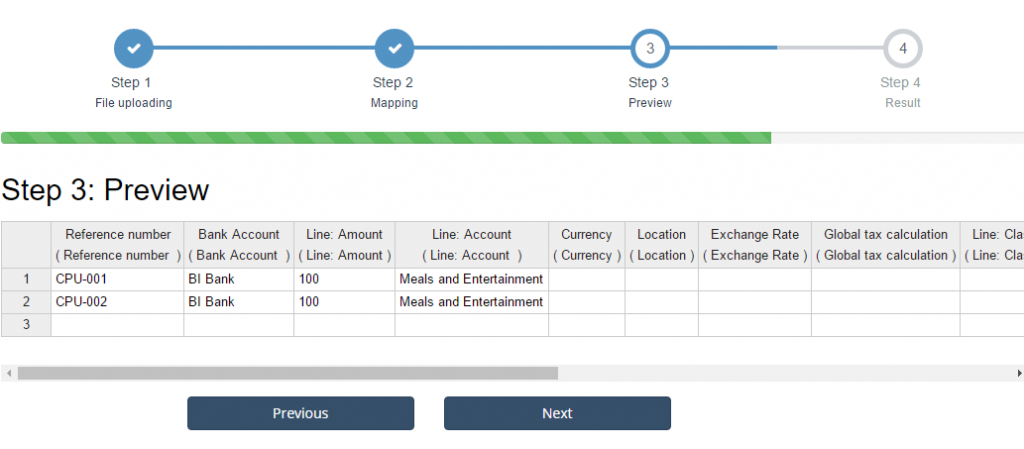

5. Review if the information is entered correctly and click on the Next button.

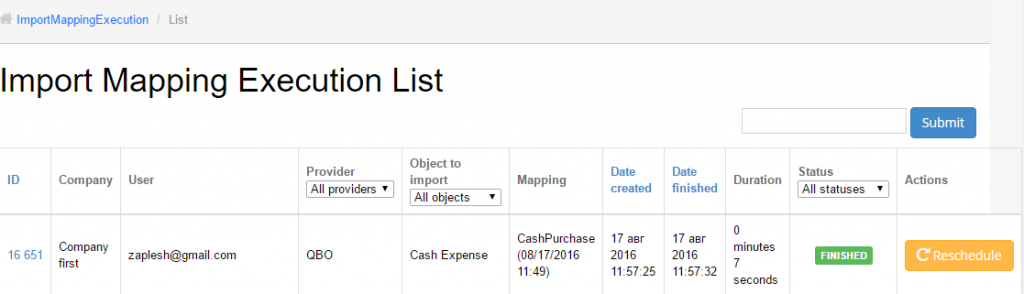

Your import is in process. Don’t wait until it’s done – you will be notified by e-mail.

See your Cash Expenses’ import result in your e-mail or in Scheduled import tab.

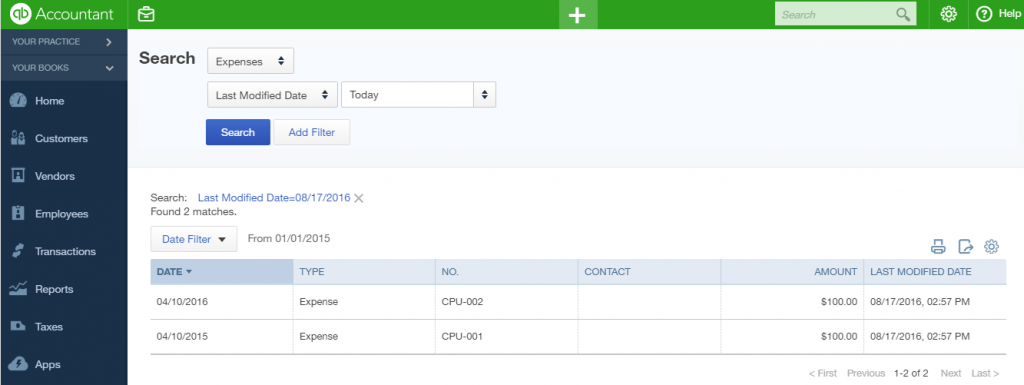

Or check it out at your QuickBooks Online account.

How-to Guide – How to import Cash Expenses into QuickBooks Online

Here is a small How-to guide that will help you to prepare your Excel properly and create correct mapping:

| QuickBooks Field | Business Importer Name | Description | Example |

|---|---|---|---|

| DocNumber | Reference number | Reference number for the transaction. | PUR-001 |

| Bank Account | Required. Cash Purchase should have bank account.Account name or number | ||

| TxnDate | Txn date | The date entered by the user when this transaction occurred. Default date format is dd/MM/yyyy. You can change it on Settings page. | 09/20/2015 |

| TxnSource | Txn source | Used internally to specify originating source of a credit card transaction. | |

| PrivateNote | Private note | User entered, organization-private note about the transaction. | |

| DepartmentRef | Location | Location of the transaction, as defined using location tracking in QuickBooks Online. Please, provide only its name. | |

| TxnTaxDetail.TotalTax | Total tax | Total tax for the transaction. | 1524.02 |

| AccountRef | Bank Account | Required. Specifies the account name. Should have bank account. Please, provide only its name or number. | Checking |

| PaymentType | Payment method | Expense Type can be Cash, Check, or CreditCard | Check |

| EntityRef.type | Type | Specifies the party type with whom an expense is associated. Can be Customer, Vendor, Employee. | Customer |

| EntityRef.name | Name | Specifies the party with whom an expense is associated. Please, provide only its name. | Cool Cars |

| TxnSource | Txn source | Used internally to specify originating source of a credit card transaction. | |

| GlobalTaxCalculation | Global tax calculation | Method in which tax is applied. Allowed values are: TaxExcluded, TaxInclusive, and NotApplicable. | TaxExcluded |

| Update Cash Purchase | If true app will find Cash Purchase with same Reference number and will update. | true | |

| Line | Line: Description | Free form text description of the line item that appears in the printed record. Maximum of 4000 characters. | |

| Line: Amount | The amount of the line item. | 1234.50 | |

| Line: Customer | Name of the Customer associated with the expense. Please, provide only its name. | ||

| Line: Class | Reference to the Class associated with the expense. Please, provide only its name. | ||

| Line: Account | Name of the Expense account associated with the service/non-sellable-item billing. Please, provide only its name or number. | ||

| Line: Billable status | The billable status of the expense. Valid values: Billable, NotBillable, HasBeenBilled | Billable | |

| Line: Tax code | The TaxCodeassociated with the sales tax for the expense. Please, provide only its name. | ||

| Line: Tax amount | Sales tax paid as part of the expense. | 1251.02 |

Check out the Cash Expenses results

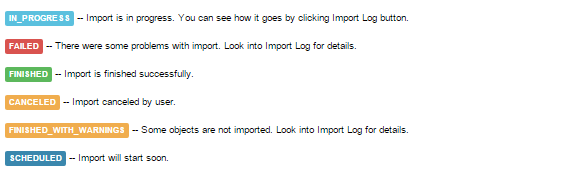

There are 5 types of import results.

Errors in Cash Expenses import

The most common errors and ways to solve them.

There are 7 most common errors made by our clients when they import Cash Expenses into QuickBooks online. To prevent this happening, we have reviewed all of them and given solutions below.

| Problem | Error occurs | Solution | Correct example |

|---|---|---|---|

| Wrong date format is used. | WARNING Error parsing date 01-14-2015. : Expected format currently MM/dd/yyyy, but you can change it on your profile page. | Change date format to MM/dd/yyyy. | 01/14/2015 |

| You haven’t got an account (Bank Account) with this name in your QuickBooks Online account. | ERROR Purchase CPU-001: CP: Account with Name = “BI Bank” is not found in your QuickBooks Online account (‘s Company). | Create a Bank Account with this name in your QuickBooks Online. | Southside-bank Of America |

| You haven’t got an account (Expense account ) with this name in your QuickBooks Online account. | Account with Name = “Meals and Entertainment” is not found in your QuickBooks Online account (‘s Company).Purchase CPU-001 | Create an Expense Account with this name in your QuickBooks Online account. | Meals and Entertainment |

| You have errors in mapping | Required parameter Line.AccountBasedExpenseLineDetail.AccountRef: is missing in the request. | Please, revise your mapping one more time. | Line.AccountBasedExpenseLineDetail.AccountRef = Line: Account (Expense account) |

| Invalid Currency code | ERROR Purchase CPU-001: Invalid or Unsupported currency type supplied. Supplied value:US. | Specify Currency code (CurrencyRef) . Choose letters according to ISO 4217. For example, USD, EUR, CAD, GBP. | USD |

| Duplicated number of Check | ERROR Purchase CPU-001: Duplicate Document Number Error You must specify a different number. This number has already been used. | Please, write a new number of Cash Expense.

Or |

PUR-021 |

| Wrong Print status | ERROR Purchase CPU-001: Property Name:Can not construct instance of com.intuit.schema.finance.v3.PrintSt specified is unsupported or invalid. | Valid values: NotSet, NeedToPrint, PrintComplete. | NeedToPrint |

| Wrong Billable status | ERROR Purchase CPU-001: Property Name:Can not construct instance of com.intuit.schema.finance.v3.BillableSt specified is unsupported or invalid. | The billable status of the expense. Valid values: Billable, NotBillable, HasBeenBilled | Billable |

Remember, that any question you can address us. We will be glad to help you!

Just leave us a message, call us on (469) 629-7891 or write to support@cloudbusinesshq.com.

Comments open