How to import Sales Receipt in QuickBooks Desktop

Connect QuickBooks Desktop and Business Importer Desktop applications:

Step 1:

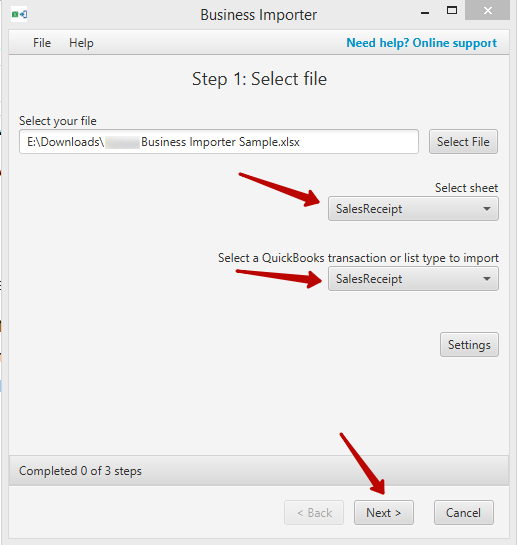

Select your file (.xslx, .csv) containing Sales Receipt. You can set up the sheet with the help of the Business Importer Desktop excel sample file, which was saved on your desktop when you installed the application.

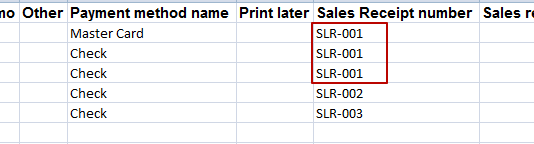

* If you need to join several lines to one Sales Receipt, please specify the same RefNumber/DocNumber in the lines on import file. The app will join all the lines with equivalent RefNumber/DocNumber to one transaction.

Step 2:

Select the appropriate sheet for the import and coinciding QuickBooks transaction from the application dropdown list.

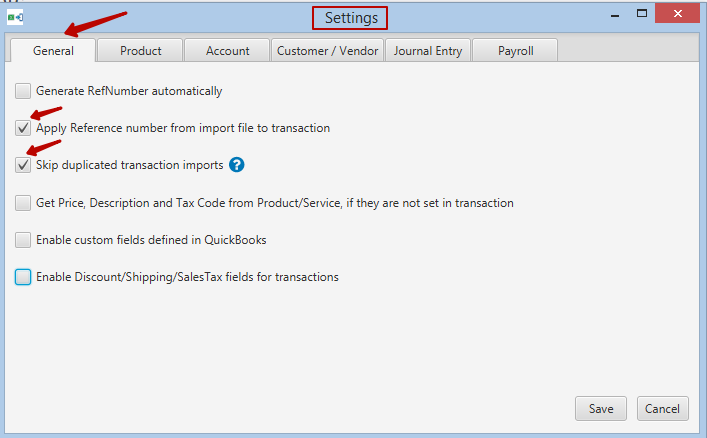

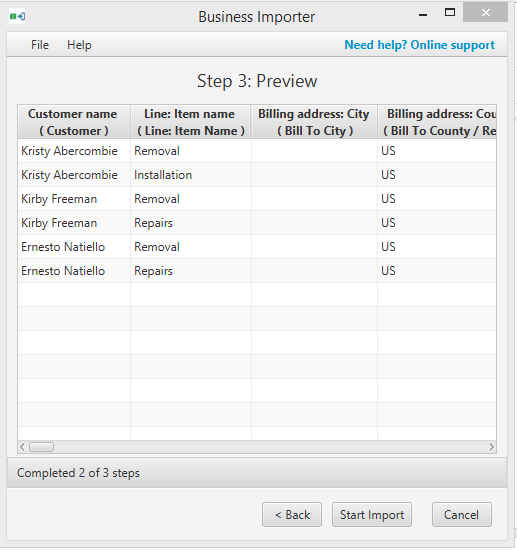

Step 3:

Edit application settings, if needed. (For example, in settings you can apply Reference Number from import file to transaction (tab General), products (Product tab), Vendors or Customers auto creation (Vendor/Customer tab)). Save the changes and click Next.

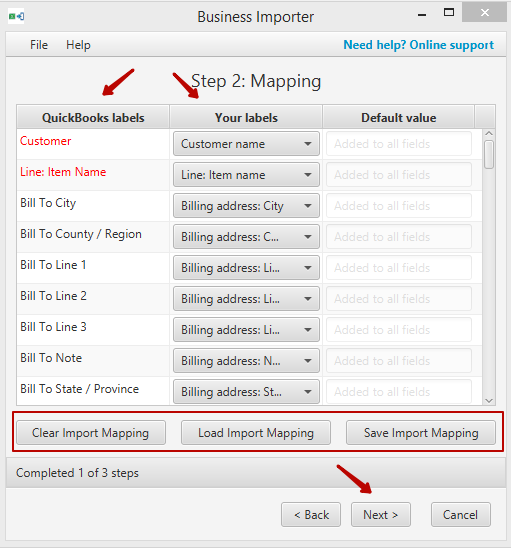

Step 4:

To set up the mapping, connect your import file labels to QuickBooks Desktop labels. You can save your Mapping to use it in subsequent imports, or upload previously saved import mapping. You can also set default values to the fields, and they will be applied to all lines of your transaction.

Note: The fields marked red are required, they are needed for the import to go through.

Step 5:

Preview the Bill information you are importing into QuickBooks Desktop. Make sure all labels are mapped in a correct way. You can make changes right in the preview table, if needed. Click Start Import.

Note: If you have changed information in your import file after you uploaded it to the application, you need to start your import again and upload the file with changes saved one more time.

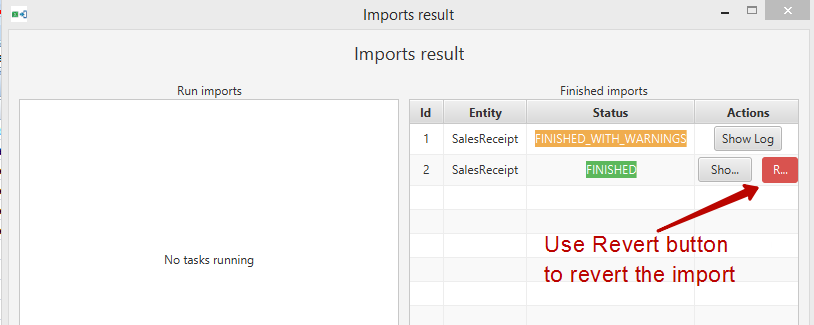

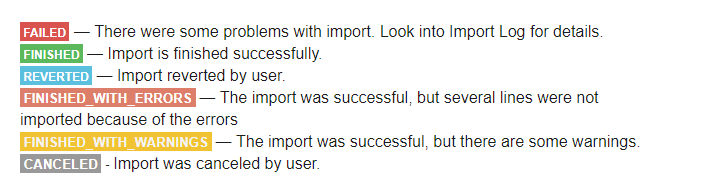

Import Results

Possible variants of the result:

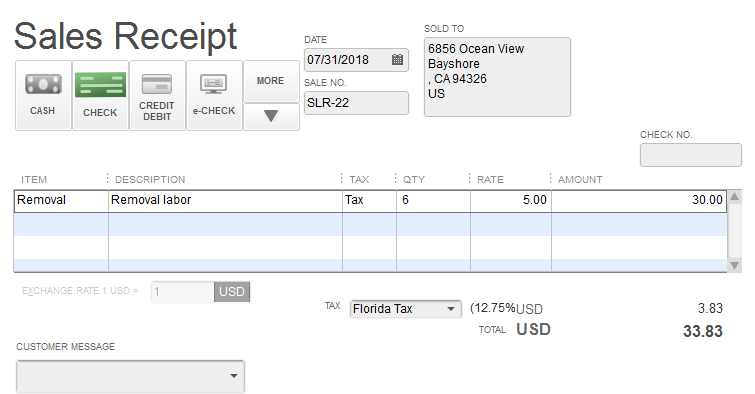

Results in QuickBooks company

Sales Receipt mapping fields:

| Business Importer Name | Description | Example |

| Customer name | A Customer Name refers to one of the customers (or customer jobs) on the list. | Lilly Rose |

| Line: Item name | The name of the Item from Item list in your QuickBooks company | Coffee Beans |

| Billing address: City | The city of the address | Sun City |

| Billing address: Country | The country of the address | USA |

| Billing address: Line 1 | The line of the address | Long Road street |

| Billing address: Line 2 | The line of the address | 4 |

| Billing address: Line 3 | The line of the address | 124 apartment |

| Billing address: Note | In a BillAddress or ShipAddress aggregate, the Note field value is written at the bottom of the address in the form in which it appears, such as the invoice form. | Any address note |

| Billing address: State | The state of the address | Florida |

| Billing address: Postal code | The postal code of the address | 123456 |

| Check number | The check number of a check that a QuickBooks user writes or receives from someone else. | Ch-001 |

| Class name | Classes can be used to separate transactions into meaningful categories. (For example, transactions could be classified according to department, business location, or type of work.) In QuickBooks, class tracking is off by default.

A Class Name refers to one of these named classes. |

Clothing |

| Currency | The currency of the transaction | USD |

| Customer message | A standard message. A customer message can be included at the bottom of a form | Thank you for your business |

| Deposit to account | Refers to the account where these funds will be (or have been) deposited. In a Receive Payment request, the default is Undeposited Funds if this is not included in the request. | Undeposited Funds |

| Discount amount | The amount of discount applied | 10 |

| Discount description | The discount description | To Florida customers only |

| Discount item name | The name of discount item from QuickBooks company | Florida customers Discount |

| Discount tax code | States will the discount of the line be taxable or not using TAX of NON values. | NON |

| Due date | Еhe due date of the transaction. | 06.06.2018 |

| Email later | If this is set to true, at runtime the customer referenced in this transaction will be checked for a valid email address. If there is no valid email address, the request will fail. If there is a valid email address currently in QuickBooks for the customer, and the request succeeds, the transaction will be added to QuickBook’s list of forms to be emailed, possibly in a batch.

Notice that setting this field to true does not actually perform the emailing. Only the QuickBooks user can do that from within QuickBooks. |

True |

| Exchange rate | The exchange rate is the market price for which this currency can be exchanged for the currency used by the QuickBooks company file as the “home” currency. The exchange rate should be considered a snapshot of the rates in effect at the AsOfDate. You can update the exchange rate using the exchange rate property when you add a transaction. However, you need to obtain and supply the exchange rate. If you are using USD (United States Dollars) as the home currency and are connected to the Internet, you can download the current exchange rates for all active currencies automatically in the QuickBooks UI by selecting Lists->Currency->Activities->Download latest exchange rates. |

1,34 |

| FOB | QuickBooks uses the term FOB, freight on board, to indicate the place from which the product is shipped. The FOB has no accounting implications | Florida |

| Line: Amount | A monetary amount. | 200 |

| Line: Class name | Item Classes can be used to separate transactions into meaningful categories. (For example, transactions could be classified according to department, business location, or type of work.) In QuickBooks, class tracking is off by default. | Clothing |

| Line: Description | Description text line. | A very good product. |

| Line: Inventory bin | The inventory bin | Second Bin. |

| Line: Inventory site | Еhe inventory site name. | Sun Town |

| Line: Other 1 | Other 1 is standard QuickBooks custom field available to transactions. The Other field is a transaction-level field, like the FOB field, PO Number field, and so forth. | Information |

| Line: Other 2 | Other 2 is standard QuickBooks custom field available to transactions. The Other field is a transaction-level field, like the FOB field, PO Number field, and so forth. | Information |

| Line: Price | The price of the product | 210 |

| Line: Quantity | If an item line add on a transaction request specifies Quantity and Amount but not Rate, QuickBooks will use Quantity and Amount to calculate Rate. Likewise, if a request specifies Quantity and Rate but not Amount, QuickBooks will calculate the Amount. If a transaction add request includes a reference to an ItemDiscount item, do not include a Quantity element as well, or you will get an error. | 20 |

| Line: Serial/Lot number | The serial/lot number of the asset. | 755682376 |

| Line: Service date | ||

| Line: Tax code | The field specifies will the line be taxable or not using TAX of NON values. | TAX |

| Line: U/M | In a transaction line item, the name of the unit of measure selected from within the item’s available units. If the company file is enabled only for single unit of measure per item, this must be the base unit! | kg |

| Mark as pending | If IsPending is set to true, the sales receipt has not been completed. Pending sales might include unpaid orders, estimates, tracked hours that have not yet been billed, or sales of back-ordered items. | True |

| Memo | Message that appears in reports, but not on the sales receipt | Thanks for your work. |

| Other | Other is standard QuickBooks custom field available to transactions. The Other field is a transaction-level field, like the FOB field, PO Number field, and so forth. This field appears only once for the transaction: you can write to it and modify it. | Any text line |

| Payment method name | A customer’s payment method, for example, cash, check, or Master Card. A PaymentMethodRef aggregate refers to an item on the PaymentMethod list. | Cash |

| Print later | If IsToBePrinted is set to true, this transaction is on a list of forms to be printed later. The user can then choose to print all these forms at once. Notice that setting this field to true does not actually perform the printing. Only the QuickBooks user can do that from within QuickBooks. Setting this field to false does not prevent the QuickBooks user from printing the transaction later. It simply results in the transaction NOT being placed in the list of transactions to be printed. |

True |

| Sales Receipt number | Doc number of the transaction | SR-001 |

| Sales rep | A sales representative must be on the Employee, Vendor, or Other Names list within QuickBooks. Sales representative’s names and initials appear on the Rep drop-down list on QuickBooks sales forms. A Sales Rep refers to a person on the Sales Representatives list. | Janice Johnson |

| Shipping date | The date the goods were shipped. | 05.05.2018 |

| Shipping address: City | The city of the address | Sun City |

| Shipping address: Country | The country of the address | USA |

| Shipping address: Line 1 | The line of the address | Long Road street |

| Shipping address: Line 2 | The line of the address | 4 |

| Shipping address: Line 3 | The line of the address | 124 apartment |

| Shipping address: Note | In a BillAddress or ShipAddress aggregate, the Note field value is written at the bottom of the address in the form in which it appears, such as the invoice form. | Any address note |

| Shipping address: State | The state of the address | Florida |

| Shipping address: Postal code | The postal code of the address | 123456 |

| Shipping method name | A shipping method, for example, standard mail or overnight delivery. A ShipMethodRef aggregate refers to an item on the Shipping Method list. | |

| Shipping amount | The amount if shipping | 20 |

| Shipping Sales Tax Code | If the line should be taxable use TAX value for the field, if not use NON value. | TAX |

| Shipping item name | The name on shipping item of the transaction. | Shipping |

| Tax item | The Name of Sales Tax from your QuickBooks company. | USA ST |

| Tax Item2 | The Name of Sales Tax from your QuickBooks company. | Florida ST |

| Tax Item3 | The Name of Sales Tax from your QuickBooks company. | Sun Town ST |

| Template name | Template element refers to one of the templates from QuickBooks company. | SR Template |

| Transaction date | The date of the sales receipt. | 05.05.2018 |

| Update Sales Receipt | Set true value if you want to update existing Sales Receipt or false value if you do not want to do that. | True |

Most common errors during Sales Receipt Import:

| Problem | Error | Solution | Correct example |

| You have specified the same tax in both columns | There is an invalid reference to QuickBooks Item “San Tomas” in the SalesReceipt line. QuickBooks error message: You cannot use the same tax item in both the line items and the txn tax. | Check your tax values, one of them could be in a group of tax, specify different tax names in the cells. | Tan Tomas

Florida ST |

| The customer name specified cannot be found in your QuickBooks Company | Customer with name ‘John Doe’ not found in your company. QuickBooks error message: Invalid argument. The specified record does not exist in the list. | Specify the existing Customer Name or enable Customer/Vendor auto creation function in Business Importer Settings | Janice Johnson |

| The rate is not specified in the import file. | There was an error when converting the price “null” in the field “Rate”. | Please check your import file and specify the rate for each line of the transaction | 1.24 |

| You specified the name of the tax where the tax code should be specified. | SalesTaxCode with name ‘MyTax’ not found in your company. | Please Specify TAX or NON in that field. | TAX |

| Account for the transaction was not specified in the file. | There is an invalid reference to QuickBooks Account “null” in the Items. | Please check your import file and specify the account for transaction in each line of your import file, you can also enable account auto creation function in the Business Importer Settings. | Undeposited funds. |

Comments open