How to import Bills in QuickBooks Desktop

Connect QuickBooks Desktop and Business Importer Desktop applications:

Step 1:

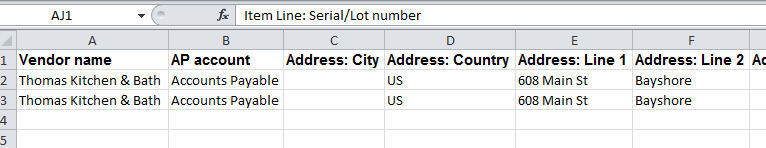

Select your file (.xslx, .csv) containing Bill. You can set up the sheet with the help of the Business Importer Desktop excel sample file, which was saved on your desktop when you installed the application.

Multilined transactions

If you want the transaction to include multiple lines grouped to one, specify the identical RefNumbers/DocNumbers to the lines needed to be joined.

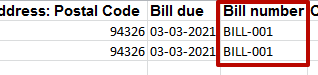

Step 2:

Select the appropriate sheet for the import and coinciding QuickBooks transaction from the application dropdown list.

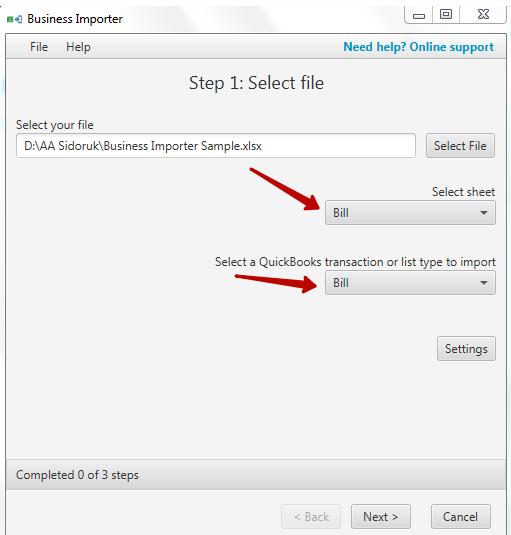

Step 3:

Edit application settings, if needed. (For example, in settings you can apply Reference Number from the import file to transaction and Skip duplicated transactions (tab General), Products (Product tab), Vendors or Customers auto creation (Vendor/Customer tab)). Save the changes and click Next.

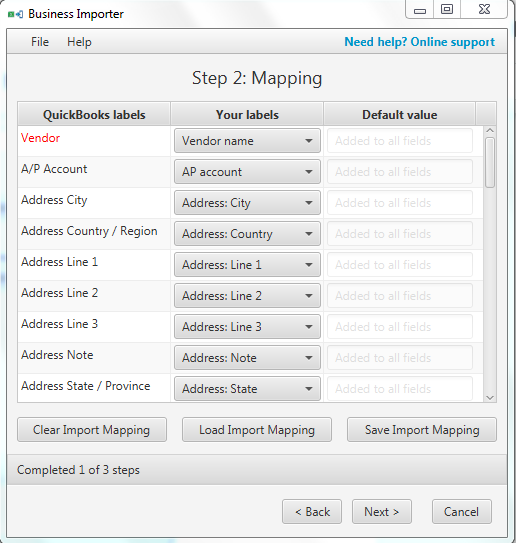

Step 4:

To set up the mapping, connect your import file labels to QuickBooks Desktop labels. You can save your Mapping to use it in subsequent imports, or upload previously saved import mapping. You can also set default values to the fields, and they will be applied to all lines of your transaction. Click Next.

Note: The fields marked red are required, they are needed for the import to go through.

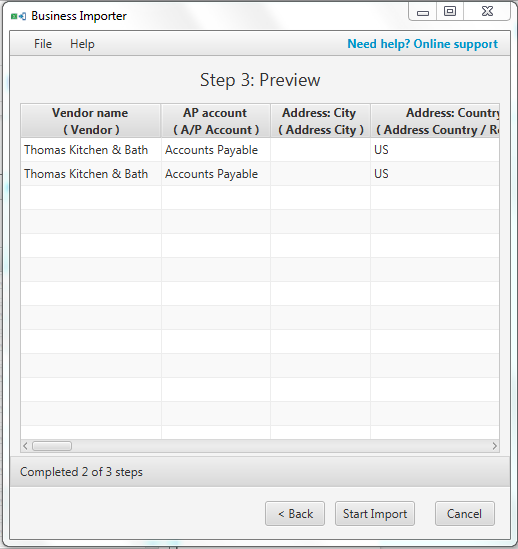

Step 5:

Preview the Bill information you are importing into QuickBooks Desktop. Make sure all labels are mapped in a correct way. You can make changes right in the preview table, if needed. Click Start Import.

Note: If you have changed information in your import file after you uploaded it to the application, you need to start your import again and upload the file with changes saved one more time.

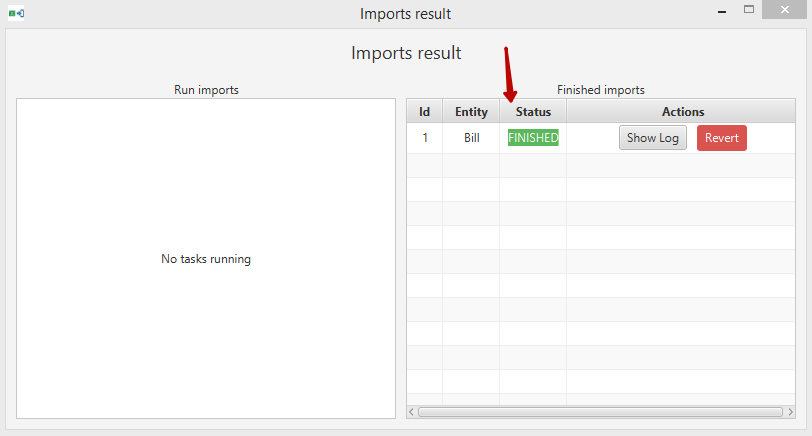

Import Results

Results from QuickBooks company

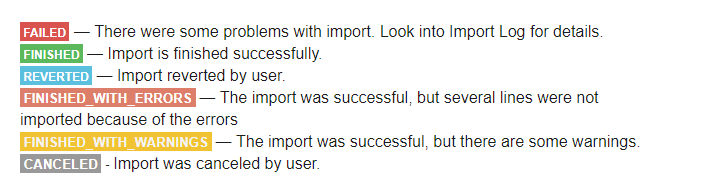

Possible variants of the result:

Common errors importing the Bill and solutions:

| Problem | Error | Solution | Correct example |

| The customer wasn’t found in your QuickBooks company. | There is an invalid reference to QuickBooks Customer “John Doe” in the Bill. QuickBooks error message: Invalid argument. The specified record does not exist in the list. | Make sure the name of your customer from the file is identical to the one you have in your company, double check extra spaces and spelling. You could also enable Customer auto creation functions to create vendors if they are not found in your company. | Janice Johnson |

| The vendor wasn’t found in your QuickBooks company. | There is an invalid reference to QuickBooks Vendor “RollsMotors” in the Bill. QuickBooks error message: Invalid argument. The specified record does not exist in the list. | Make sure the name of your vendor from the file is identical to the one you have in your company, double check extra spaces and spelling. You could also enable Vendor auto creation functions to create vendors if they are not found in your company. | Rolls Motors |

| Products are not specified in the file, or specified in a wrong way. | There was an error when saving a Bill. QuickBooks error message: You have no items or one or more of your amounts is not associated with an item. Please enter an item. | Check all the Item Names in your file and insert missing ones. | Cookies |

| Specified Account does not exist in your QuickBooks company. | There is an invalid reference to QuickBooks AP Account “My A/P Account” in the Bill. QuickBooks error message: Invalid argument. The specified record does not exist in the list. Account with name ‘My A/P Account’ not found in your company. | Check the spelling of the account in the file, is should match the name of account in your company. If you want to create the account set the Account autocreation function in our app.A/P Account for the bill should Accounts Payable. | Accounts Payable |

| Exchange rate specified incorrectly | ExchangeRate with name ‘USD’ not found in your company. | Specify the exchange rate, of you can specify only a a currency (in Currency field)if the rate already exists in you company. | 1,25 |

Bill mapping fields

| Business Importer Name | Description | Example |

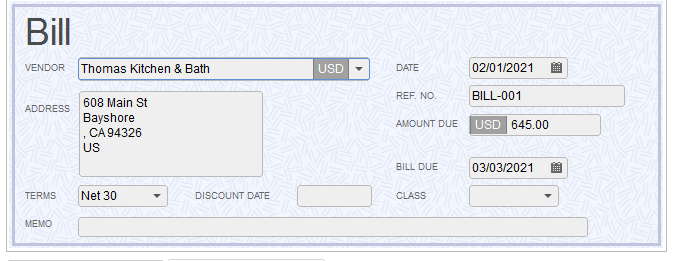

| Vendor | A vendor is any person or company from whom a small business owner buys goods and services. Please, specify only the name of the vendor. This field can contain 41 characters maximum. | Thomas Kitchen & Bath |

| A/P Account | Refers to an accounts payable account in the QuickBooks file. (The Account Type of this account will be AccountsPayable.) | Accounts Payable |

| Address City | The city name in an address. | New York |

| Address Country / Region | The country name in an address. | US |

| Address Line 1 | The first line of an address. | 608 Main St |

| Address Line 2 | The second line of an address, if needed. | Bayshore |

| Address Line 3 | The third line of an address, if needed. | Broad Road |

| Address Note | In a BillAddress or ShipAddress aggregate, the Note field value is written at the bottom of the address in the form in which it appears, such as the invoice form. | Address note |

| Address State / Province | The state name in an address. | California |

| Address Zip / Postal Code | The postal code in an address. | 3445 |

| Bill Due | The date on which payment is due. | 05.08.2018 |

| Bill Number | A string of characters that refers to this transaction. | Bill-001 |

| Currency | Currency used in transaction. | USD |

| Exchange Rate | The exchange rate is the market price for which this currency can be exchanged for the currency used by the QuickBooks company file as the “home” currency. | 1.29 |

| Expense Line: Account | The Account list is the company files list of accounts. An AccountRef aggregate refers to one of these accounts. | Materials |

| Expense Line: Amount | A monetary amount. | 200 |

| Expense Line: Billable Status | The billing status of this item line or expense line | Billable, NotBillable,HasBeenBilled |

| Expense Line: Class Name | Classes can be used to separate transactions into meaningful categories. (For example, transactions could be classified according to department, business location, or type of work.) In QuickBooks, class tracking is off by default. | Remodel |

| Expense Line: Customer | The customer list includes information about the QuickBooks users’ customers and the individual jobs that are being performed for them. A Customer aggregate refers to one of the customers (or customer jobs) on the list. | Remodel Bathroom |

| Expense Line: Memo | Additional information about this expense line | Freight |

| Item Line: Amount | A monetary amount. | 300 |

| Item Line: Class Name | Classes can be used to separate transactions into meaningful categories. (For example, transactions could be classified according to department, business location, or type of work.) The class tracking is off by default in QuickBooks, so please make sure you have made it on. | Remodel |

| Item Line:Cost | If both Quantity and Amount are specified, QuickBooks will use them to calculate Cost. Likewise, if both Quantity and Cost are specified, QuickBooks will use them to calculate the total Amount. | 900 |

| Item Line: Customer | The customer list includes information about the customers and the individual jobs that are being performed for them. A Customer aggregate refers to one of the customers (or customer jobs) on the list. | Remodel Bathroom |

| Item Line: Description | A descriptive text field | A good item! |

| Item Line: Inventory Bill Number | Specify the number of inventory bill | 13324 |

| Item Line: Inventory Site | Specify the inventory site | Second storage |

| Item Line: Item Name | Depending on the request containing it, Item can refer to an item on any Item list such as Item Discount, Item Inventory, and so forth, or it may accept only a subset of item types. For Bill requests, Item cannot refer to discount items or sales-tax items |

Plumb Fixtrs |

| Item Line: Quantity | If an item line add on a transaction request specifies Quantity and Amount but not Rate, QuickBooks will use Quantity and Amount to calculate Rate. Likewise, if a request specifies Quantity and Rate but not Amount, QuickBooks will calculate the Amount. If a transaction add request includes a reference to an ItemDiscount item, do not include a Quantity element as well, or you will get an error. | 3 |

| Item Line: Serial/Lot Number | The serial number of the asset. | 342543 |

| Item Line: U/M | In a transaction line item, the name of the unit of measure selected from within the item’s available units. If the company file is enabled only for single unit of measure per item, this must be the base unit! | Datail |

| Linked PO Number | The transaction you are linking to via this field must be a PurchaseOrder. | PO-001 |

| Memo | Appears in the A/P register and in reports that include this bill. | Freight |

| Shipping Account | Name of your shipping account | Shipping Account |

| Terms Name | Refers to the payment terms associated with this entity. | Standard terms |

| Transaction Date | The date of the transaction. In some cases, if you leave TxnDate out of an -Add message, QuickBooks will prefill TxnDate with the date of the last-saved transaction of the same type | 02.03.2018 |

| Update Bill | The column identifies whether the Business Importer should update the transaction with specified RefNumbre/DocNumber (‘true’ value), or not (‘false’ value). | True |

Suggest the TxnDate field be placed much higher in the mapping list.

Thank you for the comment, Steve! Our team welcomes recommendations from our clients, and we will consider your suggestion regarding the mapping list. In case you have any questions in the future, feel free to contact our support team via in-app chat or support email, and we will be glad to assist!