Linking Bill Payment to Bill

Business Importer Desktop

Follow these simple steps to import your Bill Payments file to QuickBooks desktop

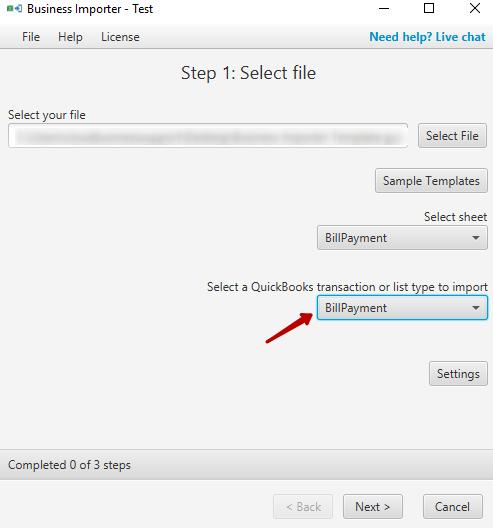

Step 1:

Select your import file, sheet in case you have several of them in your file and Bill Payment import entity.

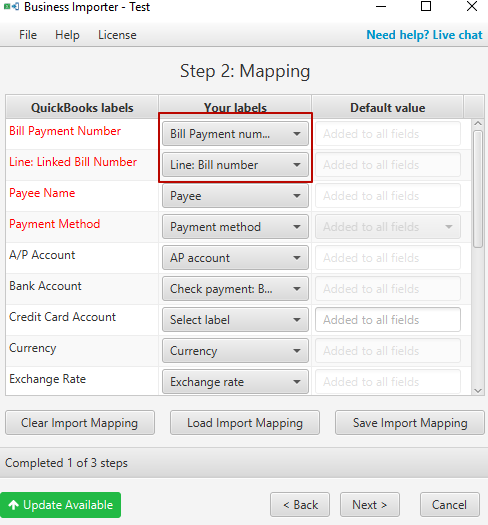

Step 2:

Map (connect) QuickBooks fields with the headings of the columns from your import file.

Note: Red fields are required. You can also save the mapping to use it for all subsequent imports, if needed, clicking “Save Import Mapping” button.

Note: If you create check payment make sure you use value “Check” in the Payment Method field and you use field Bank Account to specify your bank account. In case you create Credit Card payment make sure you use value “CreditCard” in the Payment Method field and use Credit Card Account field for your bank account.

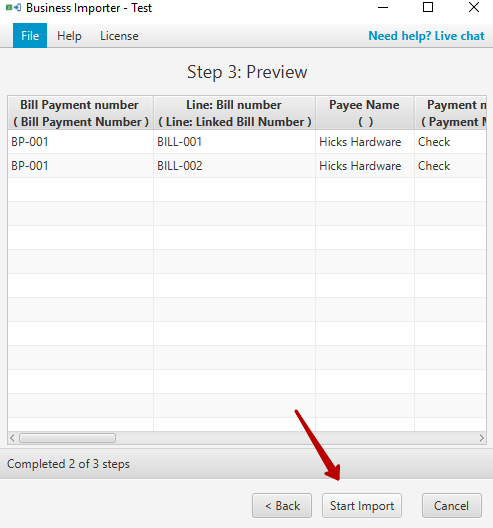

Step 3:

Preview your file clicking Next to make sure you mapped all the fields needed and then click Start Import to initiate the import.

Congratulations! You have imported your Bill Payments to QuickBooks and linked them to existing Bills.

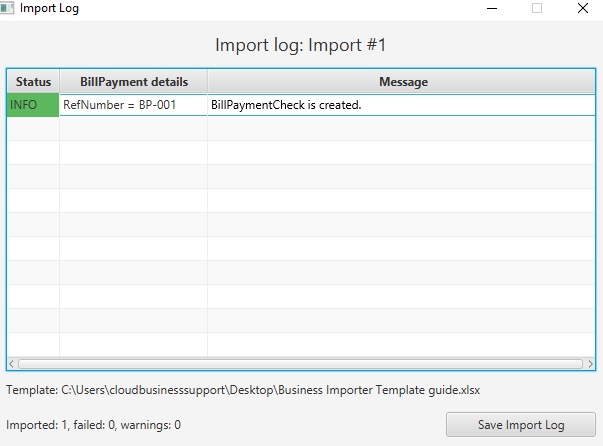

Import Results

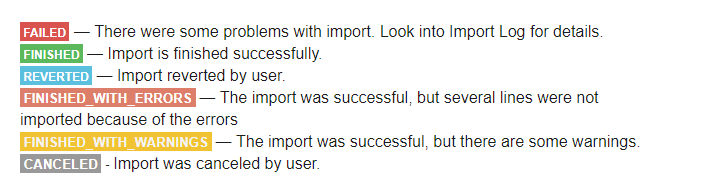

Possible variants of results in the app

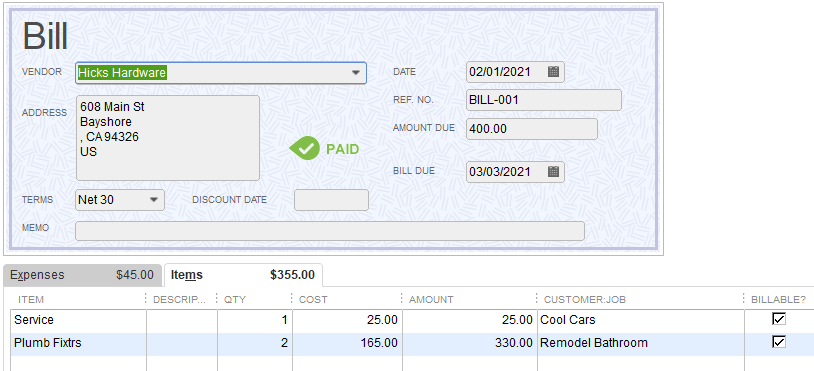

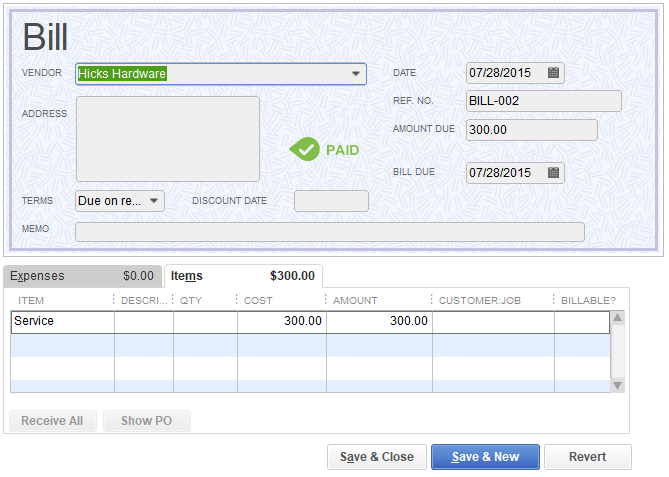

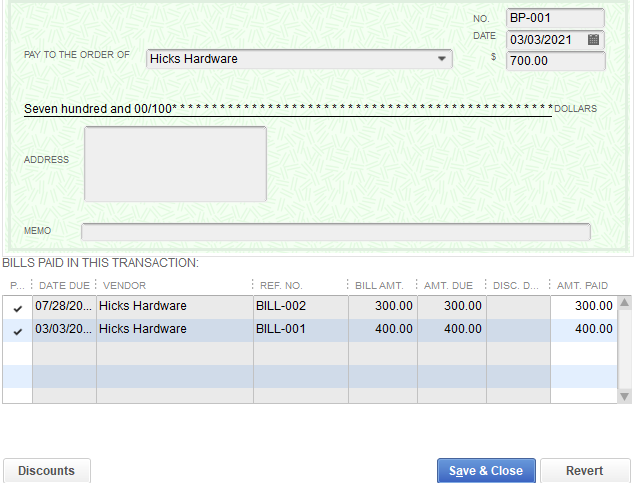

Results of the import in your QuickBooks

Bill Payment

Most common errors during Bill Payment import:

| Problem | Error | Solution | Correct example |

| The specified number of linked transaction cannot be found in the quickbooks company | Transaction with RefNumber = ” CH 1111″ is not found in your QuickBooks company. | Check whether you wrote the number of linked transaction correctly, specify number that exists in your QuickBooks company. | Bill-001 |

| Name of the currency was mapped to the Exchange rate field. | ExchangeRate with name ‘USD’ not found in your company. | Map the name of currency to the Currency field, specify exchange rate and map it to the Exchange Rate field. | USD |

| Payment Method was not specified during the import | Required field PaymentMethod is NULL | Specify the payment method as Check or CreditCard in the field Payment Method on the mapping step | Check |

| The account with the specified name cannot be found in your QuickBooks company. | Account with name ‘ Checking ‘ not found in your company. | Check the name of the account specified, it should be identical to the one you have in your QuickBooks company, no extra spaces allowed. | Checking |

| In one of the lines the value expected is missing. | Cannot get property ‘log’ on null object | Please, check the amount in the import file, and also required fields, they must be not only mapped but filled in with values. | 20 |

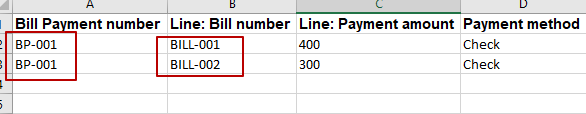

Bill Payment mapping fields:

| Business Importer Name | Description | Example |

| Bill Payment Number | The reference number of the payment transaction | BP-001 |

| Line: Linked Bill Number | The number of the Bill, the payment is associated with. | Bill-001 |

| Payee Name | Refers to a payee who is a customer, vendor, employee, or person on the other names list. | Janice Johnson |

| Payment Method | The method the payment was made by. Use Check or CreditCard values. | Check |

| A/P Account | Refers to an accounts payable account in the QuickBooks file. (The AccountType of this account will be AccountsPayable.) | AccountsPayable |

| Bank Account | The name of bank account the payment is applied to. | Checking |

| Credit Card Account | Refers to the credit card account to which this payment is being charged | Credit Card Account |

| Currency | Name of the currency of transaction. | USD |

| Exchange Rate | The exchange rate is the market price for which this currency can be exchanged for the currency used by the QuickBooks company file as the “home” currency. | 1.23 |

| Line: Discount Account | Refers to the account where this discount is tracked. | Checking |

| Line: Discount Amount | Reduces the receivable amount | 5 |

| Line: Discount Class Name | The name of Discount class | Clothing |

| Line: Payment Amount | Represents the amount assigned to a particular receivable. The sum of all PaymentAmount elements in any given receive payment transaction must not be greater than TotalAmount. | 20 |

| Memo | Additional information | That is a bill payment entity for import. |

| To be printed | Select ‘true’ or ‘false’ value for that field. | true |

| Transaction Date | The date of the transaction. | 05.05.2018 |

| Update Bill Payment Check | If you are updating the payment use ‘true’ value if this field, otherwise use ‘false’ value of leave the field unmapped. | false |

Comments open