You can import Sales Receipts into QuickBooks Online with Business Importer

5 steps

To import Sales Receipts into QuickBooks Online, please, follow 5 simple steps:

1. Sign in to Business Importer and connect it to QuickBooks.

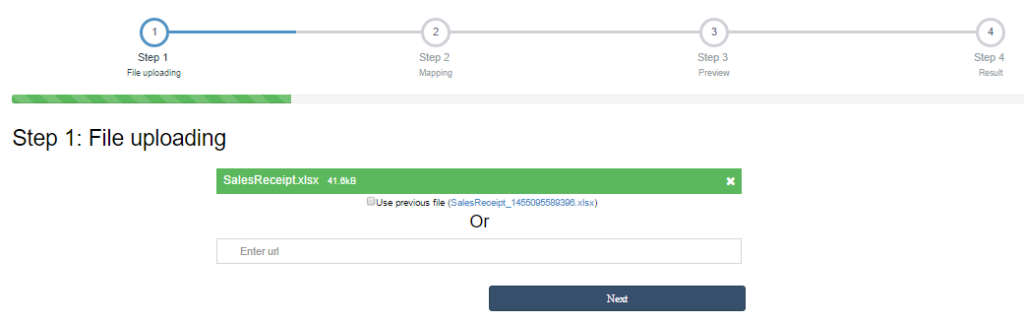

2. Go to Import tab. Upload your Excel file or paste the DropBox or Google.Drive link. Click on the Next button.

*Important Notes for your Sales Receipts list:

EmailStatus – E-Mail status of the receipt. Valid values: NotSet, NeedToSend, EmailSent.

Deposit to account name – Asset account where the payment money is deposited. If you do not specify this account, payment is applied to the Undeposited Funds account. Please, provide only Account name or account number.

PrintStatus – Valid values: NotSet, NeedToPrint, PrintComplete.

Update Sales Receipt – If true app will find Sales Receipt with same Sales Receipt number and will update.

DocNumber – There are 2 options: 1. You can write your DocNumbers in your Excel file, or 2. Use our Number AutoGeneration function.

3. Choose the list in your Excel, which contains Sales Receipts you want to import into QuickBooks. Click on the Next button.

4. Select Company (you want to import to) and Entity (Sales Receipts ), and connect Provider’s labels to Your Labels. Press the Next button.

5. Review if the information is entered correctly and click on the Next button.

Your import is in process. Don’t wait until it’s done – you will be notified by e-mail.

See your Sales Receipts import result in your e-mail or in Scheduled import tab.

How-to Guide – How to import Sales Receipts into QuickBooks online

Here is a small How-to guide that will help you to prepare your Excel properly and create correct mapping:

| QuickBooks Field | Business Importer Name | Description | Example |

|---|---|---|---|

| DocNumber | Sales Receipt number | Reference number for the transaction. | INV-001 |

| CustomerRef | Customer name | Required field. Name of customer. Please, provide its Display name, as soon as if it is different from the one you ment, invoice will be associated with another customer. | Sonnenschein Family Store |

| BillAddr (ShipAddr) | Billing address: Line 1 (Shipping address: Line 1) | First line of the address. Maximum of 500 chars. |

12 Ocean Dr. |

| Billing address: Line 2 (Shipping address: Line 2) | Second line of the address. Maximum of 500 chars. |

||

| Billing address: Line 3 (Shipping address: Line 3) | Third line of the address. Maximum of 500 chars. |

||

| Billing address: City (Shipping address: City) | City name. Maximum of 255 chars. |

Half Moon Bay | |

| Billing address: Postal code (Shipping address: Postal code) | Postal code (zip code for USA and Canada). Maximum of 31 chars. |

94213 | |

| Billing address: Country (Shipping address: Country) | Country name. Maximum of 255 chars. |

US | |

| Billing address: Region (Shipping address: Region) | Region within a country (state name for USA, province name for Canada). Maximum of 255 chars. |

CA | |

| BillEmail | Bill e-mail | Identifies the e-mail address where the invoice is sent. If EmailStatus is NeedToSend, Billing e-mail is required. Maximum of 100 chars. |

payments@intuit.com |

| EmailStatus | E-mail status | EMail status of the receipt. Valid values: NotSet, NeedToSend, EmailSent |

NeedToSend |

| CustomerMemo | Customer memo | User-entered message to the customer; this message is visible to end user on their transactions. Maximum of 1000 chars. | Thank you for your business and have a great day! |

| DepartmentRef | Location | Location of the transaction, as defined using location tracking in QuickBooks Online. Please, provide only its name. | Marketing Department |

| Update Sales Receipt | If true app will find Sales Receipt with same Sales Receipt number and will update. | true | |

| Line | Line: Amount | The amount of the line item. | 10 |

| Line: Description | Free form text description of the line item that appears in the printed record. Maximum of 4000 chars. | Rock Fountain | |

| Line: Item name | Reference to an Item object. Please, provide only its name. | Rock Fountain | |

| Line: Quantity | Number of items for the line. | 2 | |

| Line: Service date | Date when the service is performed. Default date format is dd/MM/yyyy. You can change it on Settings page. | 09/05/2015 | |

| Line: Tax code name | Reference to the TaxCodefor this item. Please, provide only its name. | NON | |

| Line: Unit price | If used for unit price, the monetary value of the service or product, as expressed in the home currency. You can override the unit price of the subject item by supplying a new value. | 14.99 | |

| Line: Class name | Reference to the Class for the line item. Please, provide only its name. | Fountain | |

| Line: Discount amount | Amount by which the amount due is reduced. | 8.5 | |

| PrivateNote | Private note | User entered, organization-private note about the transaction. This note does not appear on the invoice to the customer. Maximum of 4000 chars. | Summary for sample Sales Receipts. |

| ShipDate | Ship date | Date for delivery of goods or services. Default date format is dd/MM/yyyy. You can change it on Settings page. | 09/01/2015 |

| ShipMethodRef | Shipping method name | Reference to the ShipMethod associated with the transaction. Please, provide only its name. | UPS |

| TrackingNum | Tracking number | Shipping provider’s tracking number for the delivery of the goods associated with the transaction. | 1Z9999999999999999 |

| DepositToAccountRef | Deposit to account name | Asset account where the payment money is deposited. If you do not specify this account, payment is applied to the Undeposited Funds account. Please, provide only Account name or account number |

Checking |

| PaymentMethodRef | Payment method name | Reference Id to the PaymentMethod. Please, provide only its name. |

Check |

| PaymentRefNum | Payment ref number | The reference number for the payment received. | 10264 |

Check out the Sales Receipts import results

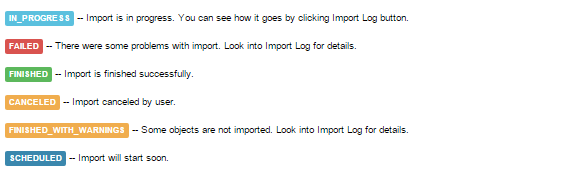

There are 5 types of import results.

Errors in Sales Receipts import

The most common errors and ways to solve them.

There are 9 most common errors made by our clients when they import Sales Receipts into QuickBooks online. To prevent this happening, we have reviewed all of them and given solutions below.

| Problem | Error occurs | Solution | Correct example |

|---|---|---|---|

| Wrong date format is used. | WARNING Error parsing date 01-14-2015. : Expected format currently MM/dd/yyyy, but you can change it on your profile page. | Change date format to MM/dd/yyyy. | 01/14/2015 |

| Invalid Currency code | ERROR SalesReceipt SLR-001: Invalid or Unsupported currency type supplied. Supplied value:US. | Specify Currency code (CurrencyRef) . Choose letters according to ISO 4217. For example, USD, EUR, CAD, GBP. | USD |

| Wrong Account | Account with Name = “name” is not found in your QuickBooks Online account (New Company). | Please, create a new account in your QuickBooks Online account before import. | Account Name |

| Wrong Print status | ERROR SalesReceipt SLR-001: Property Name:Can not construct instance of com.intuit.schema.finance.v3.PrintSt specified is unsupported or invalid. | Valid values: NotSet, NeedToPrint, PrintComplete. | NeedToPrint |

| Wrong E-mail status | Property Name:Can not construct instance of com.intuit.schema.finance.v3.EmailSt specified is unsupported or invalid. | Valid values: NotSet, NeedToSend, EmailSent | EmailSent |

| Wrong Amount | Amount is not equal to UnitPrice * Qty. Supplied value:8. | The given Quantity & Rate is not equal to given Amount. Please verify those fields. | Quantity * Rate = Amount |

| E-mail is incorrect. | Email Address does not conform to the syntax rules of RFC 822. Supplied value:http://www.intuit.com | Verify the e-mail and change it to correct one. | beryy@intuit.com |

| Warning: Product(Service) is not found in your QuickBooks Online account. | Product(Service) with Name = “Design” is not found in your QuickBooks Online account (New Company). | Create a new product (service) in your QuickBooks Online account or use auto creation of products – read how to set it. | Design |

| Tax name is incorrect | TaxCode with Name = “tax” is not found in your QuickBooks Online account (New Company). | Provide with correct tax name | For US: TAX or NON

For non-US: ‘S 20%’ or other real name of your Tax Code |

Remember, that any question you can address us. We will be glad to help you!

Just leave us a message, call us on (302) 261-3644 or write to support@cloudbusinessltd.com.