You can import Journal Entries into QuickBooks Online with Business Importer

How to import Journal Entries into QuickBooks Online: 5 steps

To import Journal Entries into QuickBooks Online, please, follow 5 simple steps:

1. Sign in to Business Importer and connect it to QuickBooks.

2. Go to Import tab. Upload your Excel file or paste the DropBox or Google.Drive link. Click on the Next button.

*Important Notes for your Journal Entries lists:

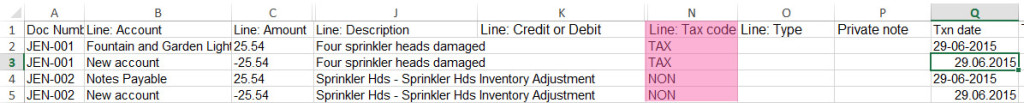

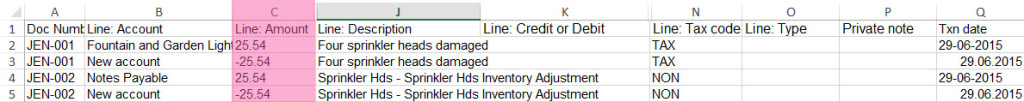

Line: Credit or Debit – Indicates whether the JournalEntry line is a Debit or Credit. Constraints: Valid values:Credit,Debit. If not specified line will be processed with following rules: if Line: Amount negative is a Credit, otherwise is a Debit.

Use the same Line: Account Name or Document Number.

DocNumber (Journal Entries number)– There are 2 options: 1. You can write your DocNumbers in your Excel file, or 2. Use our Number AutoGeneration function.

Multi-Lined Journal Entries – Journal Entries are always multilined and you can easily import them into QuickBooks online, using Business Importer. Read how to import multilined transactions.

Accounts Autocreation function – Enable this function in your Business Importer account. Read how to autocreate accounts in your QuickBooks Online account.

Line: Tax code name – TAX or NON

Line: Amount – in Journal Entries amounts depend on Credit and Debit. Use “+” and “- “for amounts in your Excel.

3. Choose the list in your Excel, which contains Journal Entries you want to import into QuickBooks. Click on the Next button.

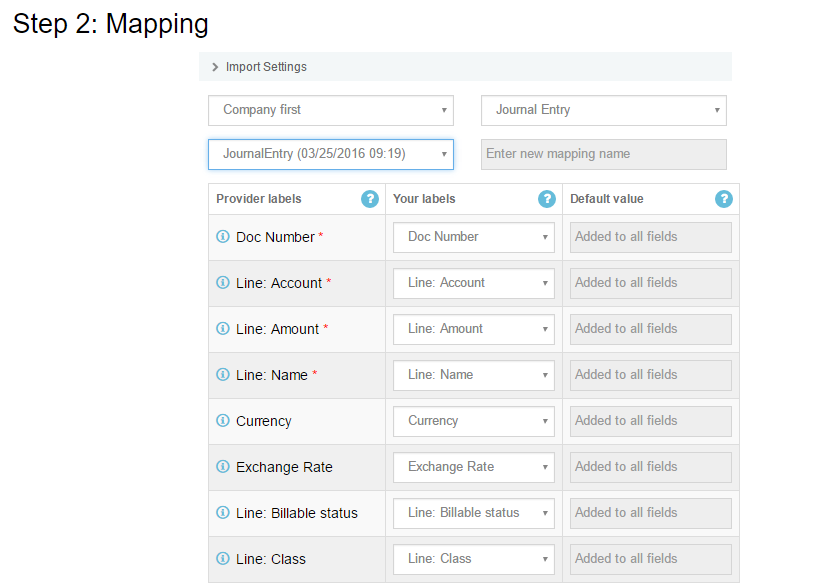

4. Select Company (you want to import to) and Entity (Journal Entries), and connect Provider’s labels to Your Labels. Press the Next button.

5. Review if the information is entered correctly and click on the Next button.

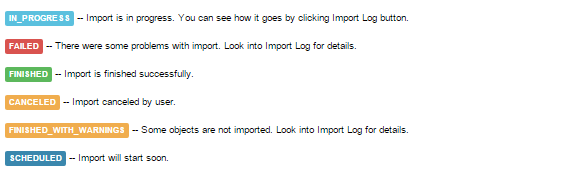

Your import is in process. Don’t wait until it’s done – you will be notified by e-mail.

See your Journal Entries import result in your e-mail or in Scheduled import tab.

How-to Guide – How to import Journal Entries into QuickBooks online

Here is a small How-to guide that will help you to prepare your Excel properly and create correct mapping:

| QuickBooks Field | Business Importer Name | Description | Example |

|---|---|---|---|

| DocNumber | Doc Number | Reference number for the transaction. | 1 |

| PrivateNote | Private note | User entered, organization-private note about the transaction. This note does not appear on the invoice to the customer. This field maps to the Memo field on the Invoice form. Maximum of 4000 chars. | |

| TxnDate | Journal date | The date entered by the user when this transaction occurred. Default date format is dd-MM-yyyy. You can change it on Settings page. | 09/20/2015 |

| Line | Line: Description | Free form text description of the line item that appears in the printed record. Maximum of 4000 chars. | |

| Line: Amount | The amount of the line item. | 10.00 | |

| Line: Credit or Debit | Indicates whether the JournalEntry line is a Debit or Credit. Constraints: Valid values:Credit,Debit. If not specified line will be processed with following rules: if Line: Amount negative is a Credit, otherwise is a Debit. |

Credit | |

| Line: Name | Reference information for the Entity associated with the JournalEntry line. Associated entities can be Customer, Employee, or Vendor. | Customer | |

| Line: Account | Reference to the Account Name associated with the JournalEntry line. Please, provide only its name. | Fountain and Garden Lighting | |

| Line: Billable status | |||

| Line: Class | Reference to the Class associated with the JournalEntry line. | ||

| Line: Location | Represents Department Reference associated with the JournalEntry line. | ||

| Line: Description | Free form text description of the line item that appears in the printed record. | ||

| Line: Tax amount | Required if TaxCodeRef is specified. Min: 0, Max:999999999 Tax amount of the line. |

||

| Line: Tax applicable on | Required if TaxCodeRef is specified. Indicates whether the tax applicable on the line is sales or purchase. Valid value: Sales, Purchase |

||

| Line: Tax code | Sales/Purchase tax code associated with the JournalEntry Line. For Non US/CA Companies | ||

| TotalTax | Total tax | Total tax calculated for the transaction, excluding any tax lines manually inserted into the transaction line list. | |

| TransactionLocationType | Transaction Location Type | For France only. The account location. Valid values include:WithinFrance(default) FranceOverseas OutsideFranceWithEU OutsideEU | FranceOverseas |

Check out the Journal Entries import results

There are 5 types of import results.

Errors in the Journal Entries import

The most common errors and the ways to solve them.

There are 6 the most common errors made by our clients when they import Journal Entries into QuickBooks online. To prevent this happening, we have reviewed all of them and given solutions below.

| Problem | Error occurs | Solution | Correct example |

|---|---|---|---|

| Wrong date format is used. | WARNING Error parsing date 01-14-2015. : Expected format currently MM/dd/yyyy, but you can change it on your profile page. | Change date format to MM/dd/yyyy. | 01/14/2015 |

| Account with given name is not found in QuickBooks Online. | ERROR JournalEntry 1 with amount [25.540]: Account with Name = “Fountain and Garden Lighting” is not found in your QuickBooks Online account (Company first). Required parameter AccountRef is missing in the request. | Create a new account in QuickBooks Online, or use our accounts autocreation function. | New account. |

| Journal Entry: Debit and Credit are not balanced. Use multilined Journal Entries. | ERROR JournalEntry 1 with amount [25.540]: Business Validation Error: You must fill out at least two detail lines. | Please, create multilined Journal Entries. Read how to create multilined transactions and import them into QuickBooks Online. | Journal Entry 1 amount 25.540

Journal Entry 1 amount – 24.540 Debit = -(Credit) |

| Journal Entry: Debit and Credit are not balanced. | ERROR JournalEntry 1 with amount [25.540, 25.540]: Please balance your debits and credits. | Please, balance Debit and Credit in your Journal Entry. | Journal Entry 1 amount 25.540

Journal Entry 1 amount – 24.540. Debit = -(Credit) |

| Tax name is incorrect | TaxCode with Name = “tax” is not found in your QuickBooks Online account (New Company). | Provide with correct tax name | For US: TAX or NON

For non-US: ‘S 20%’ or other real name of your Tax Code |

| Invalid Currency code | ERROR JournalEntry 41: Invalid or Unsupported currency type supplied. Supplied value:US. | Specify Currency code (CurrencyRef) . Choose letters according to ISO 4217. For example, USD, EUR, CAD, GBP. | USD |

Remember, that any question you can address us. We will be glad to help you!

Just leave us a message, call us on (469) 629-7891 or write to support@cloudbusinesshq.com.

Comments open