How to import Purchase Orders into QuickBooks Online

After reading this guide you will be able to import your Purchase Orders into QuickBooksⓇ Online using Business Importer.

Overview:

- How to enable Purchase Orders in QuickBooks Online

- How to import Purchase Orders into QuickBooks Online

- How to import multilined Purchase Orders into QuickBooks Online

- The most common errors and the ways to solve them

- Useful tips on how to work with your transactions with Business Importer

- Supported fields and their description in QuickBooks Online

How to enable Purchase Orders in QuickBooks Online

Before importing Purchase Orders into QuickBooks Online make sure you have enabled it in QuickBooks settings.

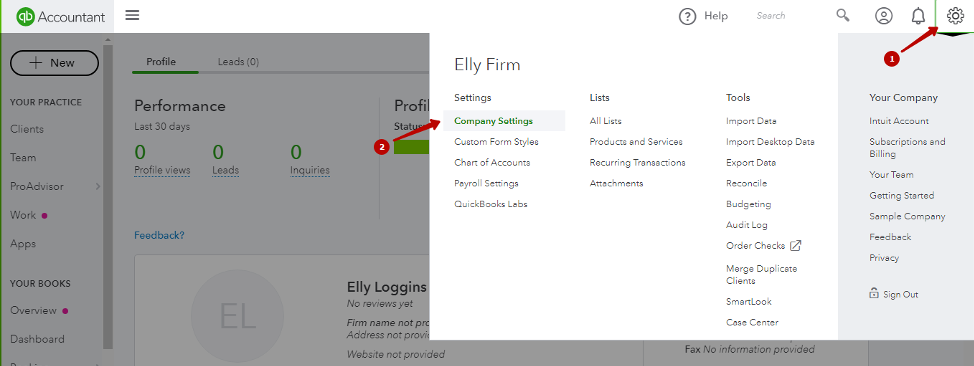

Click on Settings in top right, then press Company Settings

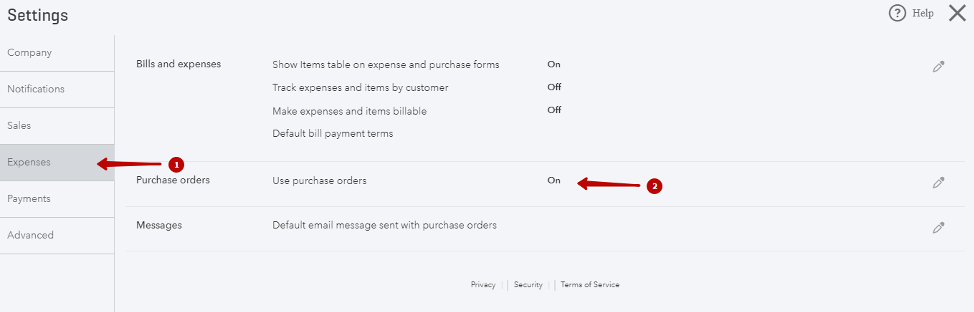

Press Expenses in the left menu, click on Purchase Orders area and tick “Use Purchase Orders”

How to import Purchase Orders into QuickBooks Online

To import Purchase Orders into QuickBooks Online, please follow these simple steps:

1. Sign in to Business Importer and connect it to QuickBooks Online.

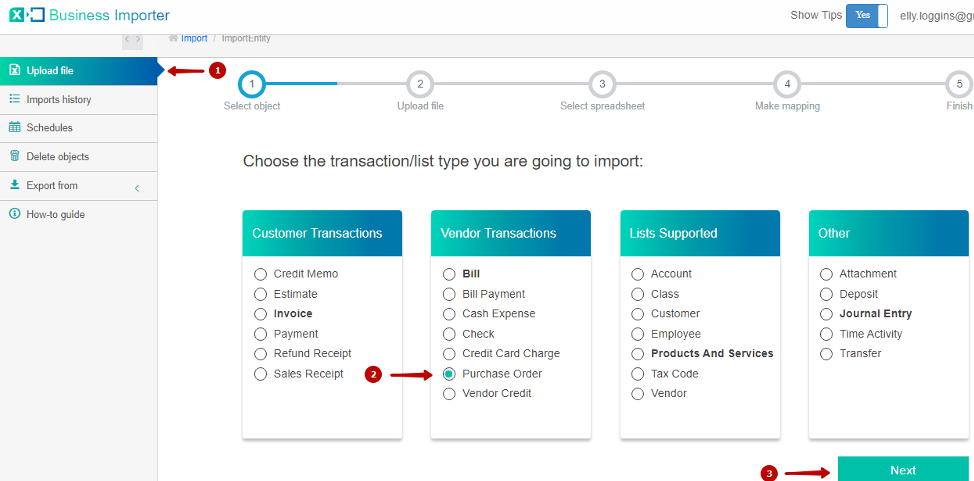

2. Go to Upload file tab and choose Purchase Order entity. Click on the Next button.

*Important Notes for your Purchase Orders list:

AP account – Many/most small businesses have a single AP account, so the account can be implied. Accounts Payable (A/P), by default.

Billable status – Valid values: Billable, NotBillable, HasBeenBilled.

PO status – Valid values are: Open, Closed.

DocNumber (Purchase Order number) – There are 2 options: 1. You can write your DocNumbers in your Excel file, or 2. Use our Number AutoGeneration function.

Products Autocreation and Accounts Autocreation functions – Enable these functions in your Business Importer account. Read how to autocreate products and autocreate accounts in your QuickBooks Online.

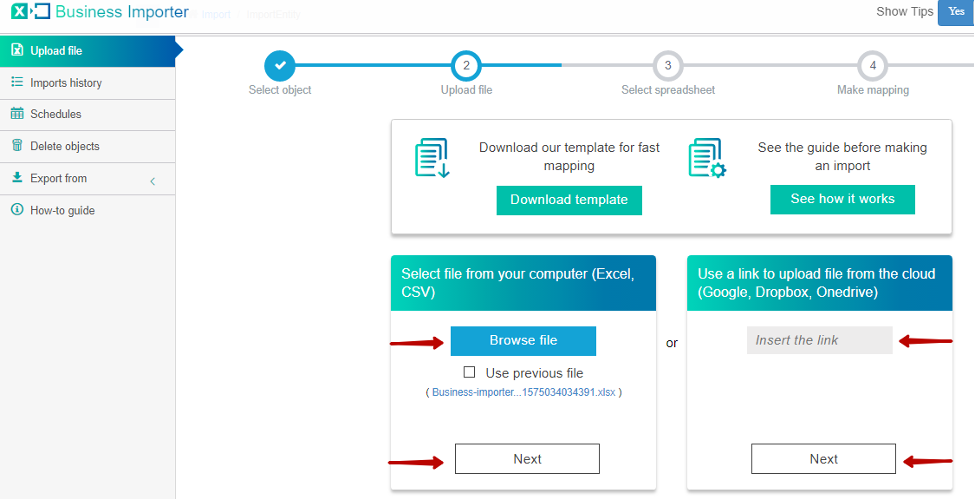

3. Press Browse file to select file from computer or put the link into “Insert the link field” in case you want to upload file from Google Sheets, DropBox or Microsoft OneDrive. Press Next.

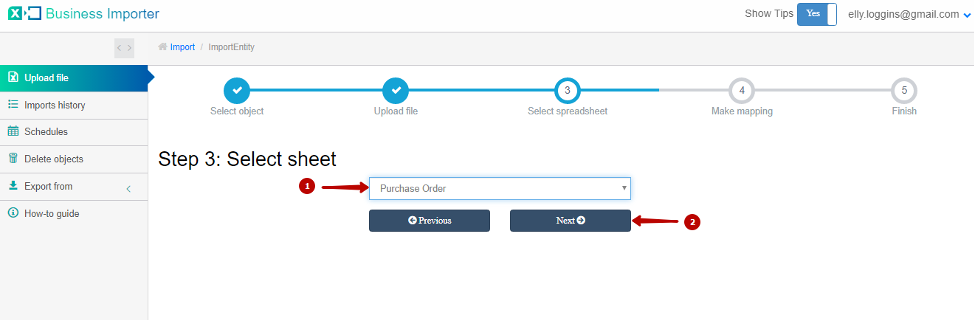

4. Select sheet with Purchase Orders in your file and click Next.

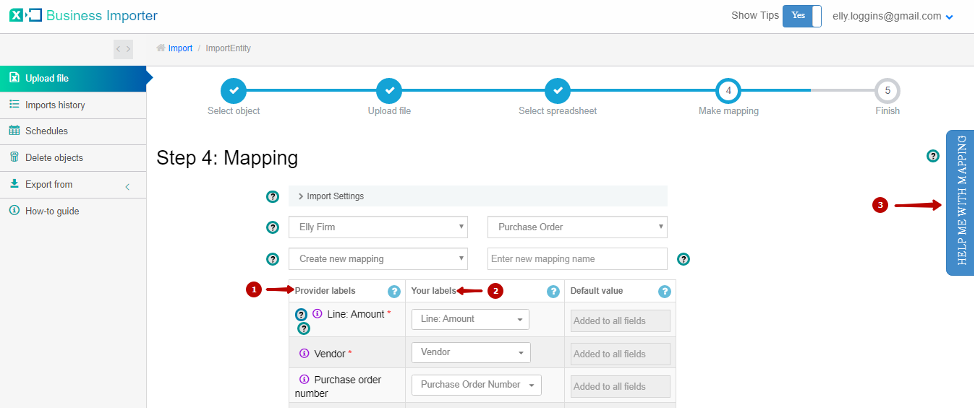

5. Map Provider Labels fields (1) with Your Labels from the file (2). To map fields properly you can use “Help me with mapping” (3).

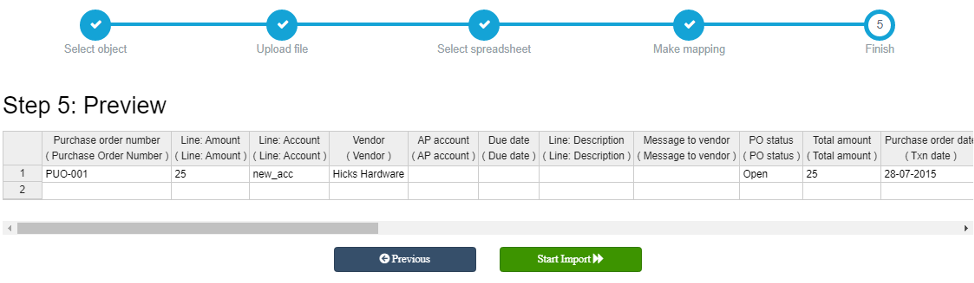

6. After mapping go to the bottom of the page and click on Next button to see the preview. Then press Start import button.

7. Congratulations, you have imported your Purchase Orders successfully.

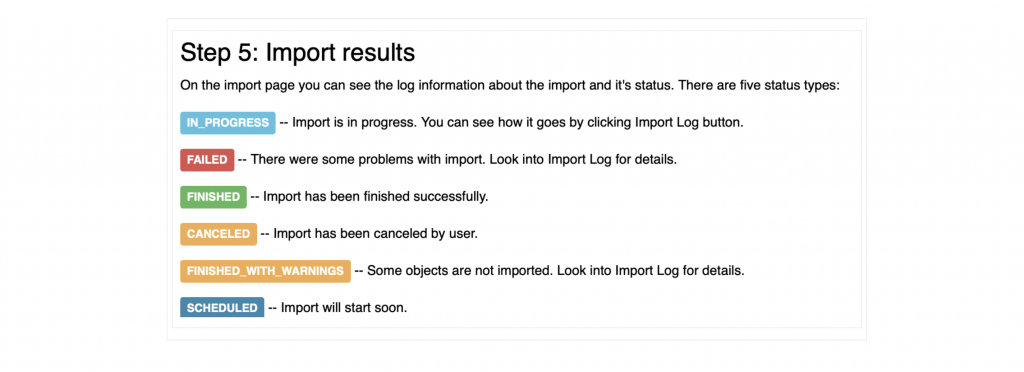

There are 5 types of import results.

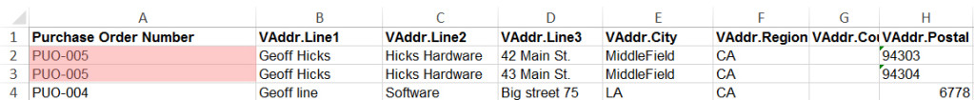

How to import multilined Purchase Orders into QuickBooks Online

Business Importer will group your Purchase Order lines into one Purchase Order with several lines, if they have the same Purchase Order Number. So make sure that the Purchase order number is the same in all of the lines of your spreadsheet you want to join into one transaction.

The most common errors and the ways to solve them

The most common errors and the ways to solve them.

There are 5 the most common errors made by our clients when they import Purchase Orders into QuickBooks online. To prevent this happening, we have reviewed all of them and given solutions below.

| Problem | Error occurs | Solution | Correct example |

|---|---|---|---|

| Wrong date format is used. | WARNING Error parsing date 01-14-2015. : Expected format currently MM/dd/yyyy, but you can change it on your profile page. | Change date format to MM/dd/yyyy. | 01/14/2015 |

| Wrong PO status | ERROR PurchaseOrder PUO-014: Property Name:Can not construct instance of com.intuit.schema.finance.v3.PurchaseOrderSt specified is unsupported or invalid. | Valid PO status: Open or Closed. | Open |

| Wrong Billable status | ERROR Purchase Order PUO-010: Property Name:Can not construct instance of com.intuit.schema.finance.v3.BillableSt specified is unsupported or invalid. | The billable status of the expense. Valid values: Billable, NotBillable, HasBeenBilled | Billable |

| Wrong Amount | Amount is not equal to UnitPrice * Qty. Supplied value:8. | The given Quantity & Rate is not equal to given Amount. Please verify those fields. | Quantity * Rate = Amount |

| Tax name is incorrect | TaxCode with Name = “tax” is not found in your QuickBooks Online account (New Company). | Provide with correct tax name | For US: TAX or NON

For non-US: ‘S 20%’ or other real name of your Tax Code |

Useful tips on how to work with your transactions with Business Importer

1. You can delete your transactions from QuickBooks with the help of Business Importer. Check out our detailed guide on the matter.

2. Another useful feature of Business Importer is that you can schedule your imports to be done automatically without you even logging in to the app.

3. Also if the results of the import contain something not expected, feel free to rollback the import, so that the app would take off your QuickBooks any imported Purchase Order in one click.

Supported fields and their description in QuickBooks Online

| QuickBooks Field | Business Importer Name | Description | Example |

|---|---|---|---|

| DocNumber | Purchase order number | Reference number for the transaction. Maximum of 21 chars. | 1 |

| TxnDate | Txn date | The date entered by the user when this transaction occurred. Default date format is dd-MM-yyyy. You can change it on Settings page. | 09/20/2015 |

| VendorRef | Vendor | Required field. Reference to the vendor for this transaction. Please, provide only its name. | Norton Lumber and Building Materials |

| ClassRef | Class | Reference type of all IDs that are taken as input or output. | |

| GlobalTaxCalculation | Global tax calculation | Method in which tax is applied. Allowed values are: TaxExcluded, TaxInclusive, and NotApplicable | TaxExcluded |

| Custom Field # | Custom Field # (Custom Field name) | Custom field based on order in your QuickBooks config. | |

| DueDate | Due date | Date when the payment of the transaction is due. Default date format is dd-MM-yyyy. You can change it on Settings page. | 09/20/2015 |

| PrivateNote | Private note | User entered, organization-private note about the transaction. This note does not appear on the invoice to the customer. This field maps to the Memo field on the Invoice form. Maximum of 4000 chars. | |

| Memo | Message to vendor | Your message to vendor. | |

| APAccountRef | AP account | Required field. Specifies which AP account the bill will be credited to. Many/most small businesses have a single AP account, so the account can be implied. When specified, the account must be a Liability account, and further, the sub-type must be of type Payables . We strongly recommend that the AP Account be explicitly specified in all cases as companies that have more then one AP account will encounter unexpected errors when relating transactions to each other. Please, provide only its name or number. | Accounts Payable (A/P) |

| VendorAddr (ShipAddr) | Vendor address: Line 1 (Shipping address: Line 1) | First line of the address. Maximum of 500 chars. |

12 Ocean Dr. |

| Vendor address: Line 2 (Shipping address: Line 2) | Second line of the address. Maximum of 500 chars. |

||

| Vendor address: Line 3 (Shipping address: Line 3) | Third line of the address. Maximum of 500 chars. |

||

| Vendor address: City (Shipping address: City) | City name. Maximum of 255 chars. |

Half Moon Bay | |

| Vendor address: Postal code (Shipping address: Postal code) | Postal code (zip code for USA and Canada). Maximum of 31 chars. |

94213 | |

| Vendor address: Country (Shipping address: Country) | Country name. Maximum of 255 chars. |

US | |

| Vendor address: Region (Shipping address: Region) | Region within a country (state name for USA, province name for Canada). Maximum of 255 chars. |

CA | |

| Vendor address: Note (Shipping address: Note) | Note | ||

| POStatus | PO status | Purchase order status. Valid values are: Open, Closed. | Open |

| Line | Line: Description | Free form text description of the line item that appears in the printed record. Maximum of 4000 chars. | |

| Line: Amount | The amount of the line item. | 10.00 | |

| Line: Product name | Reference to the Item. When a line lacks an Item it is treated as documentation and the Line.Amount attribute is ignored. Please, provide only its name. | ||

| Line: Unit price | Unit price of the subject item as referenced by Item. | Garden Supplies | |

| Line: Quantity | Number of items for the line. | 40 | |

| Line: Tax code | Reference to the SalesTaxCodefor this item. Please, provide only its name. | NON | |

| Line: Customer | Reference to the Customer associated with the expense. Please, provide only its name. | Cool Cars | |

| Line: Billable status | The billable status of the expense. Valid values: Billable, NotBillable, HasBeenBill |

Billable |

Remember: if you have any questions you can address them to us. We’ll be glad to help you!

Just leave us a message filling out our contact form or use the phone/email mentioned in the footer of every page.